'Trading is a process of observing the market's action until such a time you can find and form trading ideas and get involved.'**

Thursday, August 1, 2013

Market Update

Market indices continues to move upside for the FOMC (per reports yesterday) continues to purchase notes to augment the economy. The Crude bounced back from yesterday's positive employment report coupled with the jobless claims in today's favorable result. The Gold is still struggling, it continues to move sideways. Trading today is quite tricky for most of the big moves happened in the overnight session, if you are not quite fast enough to trade in the regular session, all you can have is the dust in your face for you are late in riding the bus, just wait for the next bus to arrive.

Wednesday, July 31, 2013

Crude Trade Setup

Showing here a 1-minute chart from the Crude where this market observer able to spot the triangle pattern for a precise trade execution. Spotting this kind of pattern one need to be focused and price action should be observed keenly for the market make its move in a fast pace environment.

Monday, July 29, 2013

Bonus Stock Tip - YRCW

Introducing my free Stock Tip as a gesture for some investors/traders who follow this humble market observer (if there are). I am inclined to recommend this trucking firm as a buy between $28 to $30 with stop at $24. It might reach a sell at $40. But know your risk tolerance and study carefully the company before investing/trading. But from the technical view of this observer, there is a potential to the upside, but that's not a guarantee. Trade/invest at your own risk.

Crude is 'leaking'?

Seems the Crude is on the way to the drain from this daily chart. It is forming a head and shoulder pattern with its left (?) shoulder already lowering, a sign that a bearish sentiment is in the offing. That's what the interpretation of this 'self-proclaimed' technical observer. Well, as everybody in the market (and other pundits) has its own interpretation in the market, and we all ended up on the wrong side of the market. But that's how in the market, we can make our own opinion since nobody knows what the market will do next. The market is an exercise of human behavior, and all human make drastic action at any given moment. But I guess the Crude market right now is on the way down or it might turn sideways. The sentiment this week in the market is of 'indecision' because of the weekly calendar events. Participants are gauging each others throat what the next move might/will be. But according the Art Cashin, CNBC contributor, we're going to expect some fireworks this week. Let's see what that fireworks would be. Also, Prince Khalid Al Waleed of Saudi Arabia caution the OPEC last week that Crude oil is not much going to be in-demand in the US for sometime because of the continuous exploration of domestic 'fracking'.

Saturday, July 27, 2013

A Climatic 'V' Position

A very powerful reversal happened this Friday's market, especially for the Dow and the S&P as shown from this 15-minute chart. Notice the hard drop (catching the falling knife) that originates from the Globex (overnight session) till the first hour or so from the open. A powerful 'v' (position???) formation emerge that turn the tide to the bull side. Catching this kind of trade is the best opportunity even in the middle portion of the trade. You don't need to catch or buy the low (deep) and sell at the top, just trade the middle portion is the best trade to make a gain, as the famous Bernard Baruch profess, 'I made my money selling early'. Just ride the 4ema (the blue line) and you will not go anywhere except to the bank!

Is Gold 'Digging' Up?

Was looking up at the Gold Futures the past week and seems it's starts to rise up from the 'dead'? With the daily chart below, the July contract is forming a small 'cup with a handle' pattern, a sign of a bullish trend. And it formed a 'w' pattern, with a double support. I guess John Paulson starts to have a sigh of relief, for his position in the Gold had been battered for almost a year on the bear side. Ready to 'dig' for the Gold?, I guess it will be good now for the 'gold diggers'!

Monday, July 15, 2013

Visa (V) - A Classic Example of Long Term Investment

Showing here a monthly and weekly chart of Visa since its IPO in the latter part of 2009. The monthly chart shows the classic cup with a handle pattern, a bullish sign. And the other is the weekly chart showing its unprecedented upward movement. This is the kind of Warren Buffet/Peter Lynch classic example of long term investment, buy the business and sleep/or a 'buy what you know' thing.

Sunday, July 14, 2013

Is the 80/20 Pareto Principle Applies to Trading?

Been examining the Pareto Principle of 80/20 if applies to trading, but I guess it applies so. The 20% should focus on the number of trades, that is, be selective with the days or the time to place/make a trade, not just trade here and there that leads to overtrading and incur more costs in commission. The 80% should be concentrated upon the probability of the trade setup that has the highest percent outcome.

Friday, July 5, 2013

Turning to trading Futures Crude for a change

Started to trade futures crude lately and kinda' like trading it, though it's quite volatile. Trading the crude one need to be nimble, cannot trade in a longer time frame unless you have a longer 'rope' to spread. I find trading crude is best to participate in the Globex market, the overnight session. And to capitalize on its move, scalping is the best method I find applicable.

The crude rallied the past two or three days because of the on-going events in Egypt. The chart below shows the daily move of the crude.

The crude rallied the past two or three days because of the on-going events in Egypt. The chart below shows the daily move of the crude.

Wednesday, June 26, 2013

Market is 'now detoxicated'?

Market is correcting, as shown from this daily chart, for a while? It is showing resistance as of this posting. But I guess it is forming a head and shoulder type of pattern, a sign that the bearish formation is still valid. The market is quite volatile the past trading weeks or months, it is acting in not so unpredictable move. It is like a 'drunken' individual ready to run 'amok'. That's why engaging the market when it is acting like that is not advisable, just wait when the market is already 'detoxicated'.

Monday, June 24, 2013

I told you so...'Bank Your Profits...Now or Never!'

Validating my post last April 21, 2013 that I titled 'Bank Your Profits...Now or Never?' was a reflection that the market was at the top and needs correction.

The daily charts below says it all!

And the historic market adage 'sell in May and go away' is quite valid.

The daily charts below says it all!

And the historic market adage 'sell in May and go away' is quite valid.

Saturday, June 22, 2013

Market Exuberance

Been a while not posting on this blog and was quite busy trading the market exploring the market exuberance. Trading the market the past few weeks was quite challenging and nerve wracking if i may so. The market was on the uptrend the past months or so but was on the downtrend or in its choppy mode since the second week of May. From then on the market was on its unpredictable behavior, it's like bull today bear tomorrow.

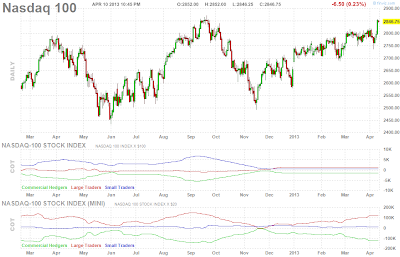

From this daily chart of the Nasdaq 100 (NQ futures, and also it is similar to the other leading indices, the S&P 500 and the Dow), you can see the participants behavior was quite imbalance, seems its suffering from ADHD? The market from then on was for the traders, not for the investors? The traders are making tons of losses and winners, the losers are the novice traders and the winners are the pros. But if you are an individual trader trying to capitalize on the market imbalances and you do your trading based from your own understanding, you can do quite well. You have an advantage over the other ordinary individuals who are just on the fence doing nothing. That's why the market is attracted to other creative individuals who are exploring other opportunities. The market offers great opportunities to everyone and it's there for the taking, you just have the interest in learning how the market works.

From this daily chart of the Nasdaq 100 (NQ futures, and also it is similar to the other leading indices, the S&P 500 and the Dow), you can see the participants behavior was quite imbalance, seems its suffering from ADHD? The market from then on was for the traders, not for the investors? The traders are making tons of losses and winners, the losers are the novice traders and the winners are the pros. But if you are an individual trader trying to capitalize on the market imbalances and you do your trading based from your own understanding, you can do quite well. You have an advantage over the other ordinary individuals who are just on the fence doing nothing. That's why the market is attracted to other creative individuals who are exploring other opportunities. The market offers great opportunities to everyone and it's there for the taking, you just have the interest in learning how the market works.

Tuesday, June 11, 2013

Saturday, April 27, 2013

Easy to be a 'LOSING' TRADER!, hard to become a WINNING TRADER?

AN EXPERIENTIAL PIECE IN THE STOCK MARKET TRADING!

A DIFFERENT KIND OF MATERIAL FOR WOULD BE TRADER!

THE INTRODUCTION: WHO AM I TO BE WELCOMED HERE IN AMERICA?

THE SCOPE: WHAT THIS PIECE IS ALL ABOUT

THE DECISION: TRADING OR INVESTING? IT’S ALL UP TO ME (OR YOU)!

THE CHALLENGE: THE HARDER I TRADE, THE UNLUCKIER I AM?

THE FINDINGS: WHEN TECHNICALS COLLIDES, CONFUSIONS BEGINS

THE RESULTS: COUNTERING FAILURES, PREPARATION AND PLANNING

THE TRADING RULES AND GUIDES

THE TACTIC/SETUP/EXECUTION PLAN: TRADE-IN-BETWEEN

THE DAILY TRADING PLEDGE AND PLAN

THE TRADING PLATFORM

THE TRADING BOOK SOURCES

THE REFERENCES: STOCK MARKET QUOTES AND PASSAGES

THE LEARNING THEMES IN TRADING

THE PSYCHOLOGICAL THEMES IN TRADING

THE PITFALL THEMES IN TRADING

THE SUCCESS THEMES IN TRADING

Sunday, April 21, 2013

Is Apple Not The Eye Of All Anymore?

Is Apple (AAPL) running out of 'gimmick' or ideas to get back from its hype? I guess that's what its chart is saying/showing. Make your own conclusion, or whatever you can/may think, this chart says it all. It's on the brink of collapse? Nobody knows, but unless they can think/innovate other 'gimmick' to get back 'the apple of the eye', nowhere to go except to the ground. Remember, what is 'up', must go 'down'?

Bank Your Profits...Now or Never?

The market's sentiment is not quite looking good as can be seen from these charts (shown below). Is the 'sell in May and go away' is in the store? I guess that's what these charts are growling. A head and shoulder pattern is forming (or it formed already?), a sign that the market is headed for a correction or is going to tank? Your guess is as good as mine. Brace for yourself, shorts (the bears) are in for the haul. Nobody knows what the market is going to do from these kind of patterns, all are in the same scenario. Profits are in for the taking, so take yours while the market is still in the uptrend.

Wednesday, April 10, 2013

The Market Rallied

The market went up smoothly today. As soon as the bell rungs, the market rallied and never look back. The bears can't do anything except to ride with the bulls behind their back and abandoned their positions. Nice to trade today, just buy in the open and sell in the close. You can make a profit equivalent for a week paycheck? Tomorrows market might get stalled a bit, probably because the market seems to get tired because of today's market action. That's normal, for the market is participated by humans. Human emotions drives the market movement. The daily chart below shows that we are in the bull market. Let's see where do we go from here. But come the month of May, where the usual adage of 'sell in May and go away' might be in the offing?

Tuesday, March 19, 2013

Today's Market Recap

The market open up today only to lose it’s steam due to Cyprus problem and maybe due to profit taking. Trading early today is not a good option for in the first few minutes into the open, the market was volatile. Lots of pressure in bringing the market to go down. And the bears were quite successful. I can see a probable short trade from the settlement price when it has a form of ‘h’ pattern. Actually, there are two ‘h’ formation, the last one between the hour of 12:00 to 1:00 pm ET. There is also a pattern of inverse head and shoulder from 1:00 to 3:00 pm ET. Trading early today is not quite advisable and not good. The market today needs some time to develop in determining the trend.

Sunday, March 10, 2013

Friday's market trade

Friday's market was not that kind of a tradeable one unless you do scalping.

But i did find one that can be traded upon.

With the chart below, though this is after the fact, but at least we can find an education for future trading.

The market drops hard when it surge before the open but did find resistance within the pivot line.

Opening for an entry after the participants lunch break.

Notice the uptrend line, it shows a higher lows.

The exit is within the R1 level.

This is just for our educational trading development.

But i did find one that can be traded upon.

With the chart below, though this is after the fact, but at least we can find an education for future trading.

The market drops hard when it surge before the open but did find resistance within the pivot line.

Opening for an entry after the participants lunch break.

Notice the uptrend line, it shows a higher lows.

The exit is within the R1 level.

This is just for our educational trading development.

Wednesday, March 6, 2013

Market On A Roll!

The market is on a roll for real!

Shown are the charts from the Tuesday's session from the leading indexes.

I guess the bears are in for a long nightmare.

The only way they can recover is to 'day trade' the market.

But for long, they are in for a long haul.

Though the market cannot be underestimated, it is always subject for a surprise drop.

Especially when its time to make profits.

So watch out!

Shown are the charts from the Tuesday's session from the leading indexes.

I guess the bears are in for a long nightmare.

The only way they can recover is to 'day trade' the market.

But for long, they are in for a long haul.

Though the market cannot be underestimated, it is always subject for a surprise drop.

Especially when its time to make profits.

So watch out!

Tuesday, March 5, 2013

The market starts rolling?

I guess that's what this chart says so.

Whenever the bears tries to take down the market, the bulls are always there to protect the market from falling.

Notice the resistance from the 2700 level, since the start of the year 2013 the market always bounced from that price.

Though it quite move erratically, the market seems showing strength.

Whenever the bears tries to take down the market, the bulls are always there to protect the market from falling.

Notice the resistance from the 2700 level, since the start of the year 2013 the market always bounced from that price.

Though it quite move erratically, the market seems showing strength.

Sunday, February 3, 2013

Friday's Market Action

Don't have much things to post the past month or so mainly due to the choppiness of the market since it surge big time in the first week of January 2013.

From thereon the market turns to boring mode and if you are not used to it you will hibernate.

But that's how the market is, either you love it or hate it.

And if you lack patience you are not supposed to be in the market.

The market exploded last Friday's session after a month of consolidation.

The best bet last Friday's trading is to buy from the pullback in the open and sell before the close.

Big time money for traders last Friday's market.

I'm sure all of them are oozing in the bar after the market savoring their profits.

Let's see come Monday's session if there is a follow through.

From thereon the market turns to boring mode and if you are not used to it you will hibernate.

But that's how the market is, either you love it or hate it.

And if you lack patience you are not supposed to be in the market.

The market exploded last Friday's session after a month of consolidation.

The best bet last Friday's trading is to buy from the pullback in the open and sell before the close.

Big time money for traders last Friday's market.

I'm sure all of them are oozing in the bar after the market savoring their profits.

Let's see come Monday's session if there is a follow through.

Monday, January 28, 2013

Love The Market...Even In Randomness

Been a while not posting any partly due to quite busy trading the markets in random way.

Though the market surge big time early in the New Year but it hardly moves upwards.

Sure, lots of in-home traders are struggling confronting the market.

Notice some traders blogger are not quite that active giving some advice/ideas as compared years back.

Is that a sign that they are giving up with the ups and downs of the market or they run out of opinions to described the markets going on?

Or some or most in-home traders decided to give up or they found a new job?

Your guess is as good as mine!

As for this struggling wannabe trader, i can say there's no way giving up loving the market.

The market is such a good friend, it gives you opportunities, lots of them.

First your sanity, if you don't know what you are doing you will suffer beyond your imaginable means.

Second, you will lose your wallet and maybe your love ones.

For it consumed your hard earned money and also the most precious of all - your time.

And lastly, after experiencing lots of hardships and debacle on your being, the rewards are forthcoming.

You will learn how to trade the market beyond its randomness and the opportunity sets it.

That's where the time where all your losses starts to recover.

Trading is a process, its like planting a fruit tree that originates from a seed.

You have to nurture that seed until it starts to grow as a tree and starts to bear fruit.

Sometimes it takes time to bear fruits that's why you have to fertilize it.

Though the market surge big time early in the New Year but it hardly moves upwards.

Sure, lots of in-home traders are struggling confronting the market.

Notice some traders blogger are not quite that active giving some advice/ideas as compared years back.

Is that a sign that they are giving up with the ups and downs of the market or they run out of opinions to described the markets going on?

Or some or most in-home traders decided to give up or they found a new job?

Your guess is as good as mine!

As for this struggling wannabe trader, i can say there's no way giving up loving the market.

The market is such a good friend, it gives you opportunities, lots of them.

First your sanity, if you don't know what you are doing you will suffer beyond your imaginable means.

Second, you will lose your wallet and maybe your love ones.

For it consumed your hard earned money and also the most precious of all - your time.

And lastly, after experiencing lots of hardships and debacle on your being, the rewards are forthcoming.

You will learn how to trade the market beyond its randomness and the opportunity sets it.

That's where the time where all your losses starts to recover.

Trading is a process, its like planting a fruit tree that originates from a seed.

You have to nurture that seed until it starts to grow as a tree and starts to bear fruit.

Sometimes it takes time to bear fruits that's why you have to fertilize it.

Thursday, January 3, 2013

The Market Surge...Big Time!

The market leap vertically welcoming the year 2013 with a big bang.

Trading Wednesday's market was a bit tricky for it surge early in the open only to lose its steam almost the whole trading day.

Was able to recover late in the trading day regaining its momentum.

For Thursday market, seems it might stall a bit and maybe will just consolidate.

But i guess the strength is still intact and might make a tight move upwards.

Trading Wednesday's market was a bit tricky for it surge early in the open only to lose its steam almost the whole trading day.

Was able to recover late in the trading day regaining its momentum.

For Thursday market, seems it might stall a bit and maybe will just consolidate.

But i guess the strength is still intact and might make a tight move upwards.

Tuesday, January 1, 2013

Happy New Trading

This year of 2013 hope would bring some kind of market improvement to our trading endeavor.

Been a while trading and figuring out how to trade the market well.

As the years passed by participating in the market, i can say trading the market is all based from the trader itself.

It's all in participants emotional behavior and well being.

Once you figure it out that its all about one's psychology, you can easily absorb how the market works.

It's not all about the technicals or market fundamentals, its all based from one's understanding how to participate in the market.

That being said, trading as all about managing one's emotions and working on yourself towards the market.

Been a while trading and figuring out how to trade the market well.

As the years passed by participating in the market, i can say trading the market is all based from the trader itself.

It's all in participants emotional behavior and well being.

Once you figure it out that its all about one's psychology, you can easily absorb how the market works.

It's not all about the technicals or market fundamentals, its all based from one's understanding how to participate in the market.

That being said, trading as all about managing one's emotions and working on yourself towards the market.

Monday, December 24, 2012

Merry Christmas Traders...

To all traders: losers; winners; beginners; old timers...

May you have a very Merry Christmas this two thousand twelve...

If you are a winning trader, good for you and keep what you are doing...

And if you are a losing trader, stop, look and listen...

Consult your inner mind if trading is the right vocation...

Merry Christmas too for the newer traders...

For they make the seasoned traders happy as ever...

For they don't know what they are doing...

They trade based from their own liking...

Thought that trading is the quickest way in money making...

Merry Christmas too for the traders educators (sic)...

For they don't make money in trading...

They turn to educating to make money as racketing...

Signing up to their alerts or recommending...

Keeps your mind boggling...

Merry Christmas too to the traders who are struggling...

For they chased their trades to keep up with pricing...

It turns out that the other side is already profiting...

Then they change their technique from day trading to milliseconds trading...

Until they found out they have no more trading (runs out of capital)...

Merry Christmas too for all seasoned traders...

May you have more "seasoned" years in market making...

For without your wits and exploiting...

The market will be dying...

And there will be no more trading...

Finally, Merry Christmas to all market participants...

Traders, investors, schemers, policymakers, ponziers, retirees, whatevers...

Your presence is highly appreciating...

For without your presence, the market is boring as ever...

A very Merry Christmas to all...

May you continue patronizing the greatest money game of all time...

May you have a very Merry Christmas this two thousand twelve...

If you are a winning trader, good for you and keep what you are doing...

And if you are a losing trader, stop, look and listen...

Consult your inner mind if trading is the right vocation...

Merry Christmas too for the newer traders...

For they make the seasoned traders happy as ever...

For they don't know what they are doing...

They trade based from their own liking...

Thought that trading is the quickest way in money making...

Merry Christmas too for the traders educators (sic)...

For they don't make money in trading...

They turn to educating to make money as racketing...

Signing up to their alerts or recommending...

Keeps your mind boggling...

Merry Christmas too to the traders who are struggling...

For they chased their trades to keep up with pricing...

It turns out that the other side is already profiting...

Then they change their technique from day trading to milliseconds trading...

Until they found out they have no more trading (runs out of capital)...

Merry Christmas too for all seasoned traders...

May you have more "seasoned" years in market making...

For without your wits and exploiting...

The market will be dying...

And there will be no more trading...

Finally, Merry Christmas to all market participants...

Traders, investors, schemers, policymakers, ponziers, retirees, whatevers...

Your presence is highly appreciating...

For without your presence, the market is boring as ever...

A very Merry Christmas to all...

May you continue patronizing the greatest money game of all time...

Saturday, December 22, 2012

Cash Is King: Printing of $100 Bills Soars

A good detective always looks for a motive when beginning an

investigation. And so, when Nick Colas discovered that the number of $100

bills printed last year suddenly spiked, the chief market strategist at

ConvergEx Group decided to figure out what was going on.

The first thing he discovered, as we discuss in the attached video, is that "$100 bills are still wildly popular and growing in popularity." On the other hand, the use of smaller denomination bills ($1, $5, $10 and $20) has been declining for over a decade, as the number of cashless transactions has steadily gone up. In fact, in the fiscal year that just ended in October, Colas writes in a recent note to clients, the U.S. Bureau of Engraving and Printing cranked out 3 billion, $100 notes.

"That's substantially higher than the run-rate of the past couple of years," Colas points out, and 50% more than the 2 billion $1 bills that were inked up. "It's actually a record amount of production," he says.

All of which begs the question, why?

Part of this new demand, he says, comes from the classic nefarious sources: drug dealers, arms smugglers, tax cheats and bribes. But some of it is also due to hoarding or the fact that more people than ever, oddly enough, are losing faith in government and/or the economy and are shunning the surety of traditional investments. It's a phenomenon that's led to a huge increase in demand for gold and other precious metals, but also for — you guessed it — $100 bills.

And it's not just here at home. While it's hard to quantify the exact amount, it is believed that the majority of $100 bills are probably being held overseas, since they are globally recognized, widely accepted and the easiest way to store wealth.

"Cash really is king if you want to preserve wealth in an increasing tax environment," Colas says, noting that while gold is a viable strategy for saving some money, "nothing beats a $100 bill if you have to buy some food."

What's interesting, or inexplicable, to many money watchers is that this huge increase in the printing of old-style $100 bills happened right before the expected launch of the new and improved $100 bills that will include a 3-D blue stripe and bell-in-an-inkwell security features. According to the Federal Reserve and its NewMoney.gov website, production problems have delayed the launch of the newest $100 notes for over a year now, though an announcement is expected soon.

In the meantime, with bank deposit rates and yields on U.S. Treasury bills at record lows and paying next to nothing, savers miss out on very little interest if they choose to hold cash rather than invest it.

But alas, there is a silver lining to be found within all of this dollar debasement that at least one Wall Street veteran points to. "It proves beyond a doubt that the dollar is still the reserve currency of choice around the world," Colas concludes. "It may not [always] be from the most savory part of the economy, but it does signal that there's still a lot of faith in the dollar."

Tuesday, December 18, 2012

Market Rally

The market did rally today not only due to fiscal cliff seemingly positive resolution but also from the participants bullish conviction.

The Santa rally is still in effect despite some economic/market hurdles.

Let's see with the remaining trading days if it will continue.

The Santa rally is still in effect despite some economic/market hurdles.

Let's see with the remaining trading days if it will continue.

Market Rally Is Now For Real?

I guess that's what these chart sentiments is showing.

It's only natural for the market to stall it's traction, but the conviction for Santa rally is still there.

It's only natural for the market to stall it's traction, but the conviction for Santa rally is still there.

Sunday, December 16, 2012

Trading Come 2013

Two weeks left trading the market this year of 2012 and we have to start planning come 2013.

If we did not do pretty well this year, we have to regroup and learn from it.

Let's move ahead and forget the mistakes.

The important thing is we have to learn from them and not (try) to repeat them again.

We need to be more passionate with our trading endeavor - as ever.

We have to look forward since trading (the market) is a forward moving train.

Sometimes we have to stop and examine what's ahead so that we can plan our moves.

This coming 2013 it seems more hurdles in the market.

Let's just explore whatever opportunities the market offers.

Let's stay cool, calm, balance, and not be driven by the impulsive euphoria.

In that way we can trade better with concrete evidence and not succumb to temptation.

I learned that trading is not to trade often, be selective with the trade locations, and need not listen to anyone except to our own self.

Looking forward for a better trading come 2013.

If we did not do pretty well this year, we have to regroup and learn from it.

Let's move ahead and forget the mistakes.

The important thing is we have to learn from them and not (try) to repeat them again.

We need to be more passionate with our trading endeavor - as ever.

We have to look forward since trading (the market) is a forward moving train.

Sometimes we have to stop and examine what's ahead so that we can plan our moves.

This coming 2013 it seems more hurdles in the market.

Let's just explore whatever opportunities the market offers.

Let's stay cool, calm, balance, and not be driven by the impulsive euphoria.

In that way we can trade better with concrete evidence and not succumb to temptation.

I learned that trading is not to trade often, be selective with the trade locations, and need not listen to anyone except to our own self.

Looking forward for a better trading come 2013.

Saturday, December 15, 2012

A Derailed Santa Rally

The rally that i had been watching in the market the past week is having a hard time getting its traction.

I guess the Santa rally everybody is expecting has been derailed due to the fiscal cliff problem.

Only two weeks left trading the market before 2013, and it seems the market will just consolidate.

Though there might be some spike(s), but profiteers will just annihilate whatever market spikes will erupt before the year ends.

It is still a traders market, better for the investors to take the holiday break now.

I guess the Santa rally everybody is expecting has been derailed due to the fiscal cliff problem.

Only two weeks left trading the market before 2013, and it seems the market will just consolidate.

Though there might be some spike(s), but profiteers will just annihilate whatever market spikes will erupt before the year ends.

It is still a traders market, better for the investors to take the holiday break now.

Tuesday, December 11, 2012

Market Will Santa Rally?

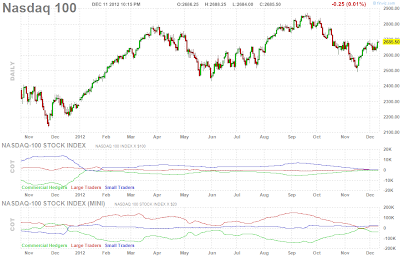

The way it looks with this daily chart from the Nasdaq futures, there is a 'spring coil' the market rally.

It is forming an inverted head and shoulder pattern, or a cup with a handle.

A pattern that a bullish scenario is unfolding the last few weeks of market trading this year of 2012.

The way i look at it, the target till the year ends is at around 2800.00 plus.

A buy signal is now appropriate with stop at 2600.00.

Let see come the days ahead if it will sustain.

It is forming an inverted head and shoulder pattern, or a cup with a handle.

A pattern that a bullish scenario is unfolding the last few weeks of market trading this year of 2012.

The way i look at it, the target till the year ends is at around 2800.00 plus.

A buy signal is now appropriate with stop at 2600.00.

Let see come the days ahead if it will sustain.

Monday, December 3, 2012

It's Santa Rally...Really?

Showing this daily chart from the Nasdaq QQQ already rallying up after some profit taking (correction).

As i mentioned from my previous post, a Santa rally might be on the way and i think this chart is proving that.

It formed a "v" formation since it bottom(ed) in mid November session.

The way i look at it, seems it is forming an inverted head and shoulder pattern here.

A sign that the bullish sentiment from the participants is highly probable.

It might struggle a bit (maybe?) in a few days, possibly a week or so but this i think the rally is on the way.

Lucky for those who where able to buy at the bottom.

In the meantime, for us traders, let's take the market on a daily basis and explore the opportunities.

As i mentioned from my previous post, a Santa rally might be on the way and i think this chart is proving that.

It formed a "v" formation since it bottom(ed) in mid November session.

The way i look at it, seems it is forming an inverted head and shoulder pattern here.

A sign that the bullish sentiment from the participants is highly probable.

It might struggle a bit (maybe?) in a few days, possibly a week or so but this i think the rally is on the way.

Lucky for those who where able to buy at the bottom.

In the meantime, for us traders, let's take the market on a daily basis and explore the opportunities.

Friday, November 23, 2012

Friday's Market

The market opened today on a high note.

It gap up in the open after the holiday break.

All the market did was to buy...buy...buy...and the sellers (shorters) were absent (where are they?).

It will be a short trading day today for the market will be closed at 1:00 pm. ET.

Let's see come Monday's market if the positive sentiment will continue.

Today's market is the best day for would be traders or for those struggling/losing traders (like this one).

Not much noise/volatility for the notorious HFT's are still drowning from the devil spirit of alcohol (err... wine?) because of the holiday? Sorry...just trying to sensationalized this post a little bit to make some attention from my readers... if there are!

But who am i to categorized that this kind of market is best to trade while the majority of the participants are out.

Through market presence regularly i can say that was the market behavior since started watching the market from years back.

It's like taking advantage from the drunkards while they are drowning and steal? profit from their absence.

The market is an exercise of human behavior and if you can read their minds (the minds of the markets), you can make the difference and take opportunities that the market offers.

It gap up in the open after the holiday break.

All the market did was to buy...buy...buy...and the sellers (shorters) were absent (where are they?).

It will be a short trading day today for the market will be closed at 1:00 pm. ET.

Let's see come Monday's market if the positive sentiment will continue.

Today's market is the best day for would be traders or for those struggling/losing traders (like this one).

Not much noise/volatility for the notorious HFT's are still drowning from the devil spirit of alcohol (err... wine?) because of the holiday? Sorry...just trying to sensationalized this post a little bit to make some attention from my readers... if there are!

But who am i to categorized that this kind of market is best to trade while the majority of the participants are out.

Through market presence regularly i can say that was the market behavior since started watching the market from years back.

It's like taking advantage from the drunkards while they are drowning and steal? profit from their absence.

The market is an exercise of human behavior and if you can read their minds (the minds of the markets), you can make the difference and take opportunities that the market offers.

Thursday, November 22, 2012

Wednesday's Market

The market barely made a move last Wednesday's trading.

Partly because of the Thanksgiving day.

Participants are already preparing for the turkey feast.

Not much volume was recorded but the sentiments is still bullish as can be seen from the charts below.

Let's see come next week regular trading if it will continue.

But i guess there is some sluggish trend in the coming days or weeks probably.

Meanwhile, let's have some market break!

Partly because of the Thanksgiving day.

Participants are already preparing for the turkey feast.

Not much volume was recorded but the sentiments is still bullish as can be seen from the charts below.

Let's see come next week regular trading if it will continue.

But i guess there is some sluggish trend in the coming days or weeks probably.

Meanwhile, let's have some market break!

Monday, November 19, 2012

The Market Really Bounced!

As i mentioned from my previous post, the market is ready to bounce and it did today.

If that is for real, i don't know, let's see in the coming trading days.

But as now the way the market is acting, looks like it's the start of the Santa rally.

If that is for real, i don't know, let's see in the coming trading days.

But as now the way the market is acting, looks like it's the start of the Santa rally.

Subscribe to:

Comments (Atom)

20130731081941.png)

20130729104808.png)

20130727035526.png)

20130727031422.png)

20130705084753.png)

20130626044007.png)

20130624072927.png)

20130624073658.png)

20130624073745.png)

20130622071843.png)