Traded the three indices at the same time on one minute chart and capture the bottom buy.

Tuesday, August 6, 2024

Tuesday, July 30, 2024

MYM & M2K Trade 7 30 2024

Good setup trade in the e mini Dow

Wednesday, July 10, 2024

Tuesday, July 9, 2024

Wednesday, July 3, 2024

Saturday, June 29, 2024

Is Trading 'Easy'?

That can be answered depends how you interpret the market based from your own participation. I made this kind of question to my own trading because I do my own trading by myself without the aid of anyone except through my own way of learning. I am not saying/boasting or tooting my horn, it's because I don't have any means to pay expensive seminars, subscribe to expensive tutors or whatever those 'great' traders are espousing that they can beat the market, or those promises that they know how to make a good trade and help you make tons or millions of 'In God We Trust' paper.

That's pure nonsense as far as this humble market observer is concern, though I can't show any kind of that tons of green paper, but based from my own humbling way of participating in the market, when it comes to making trades, trading can be done by you alone, it cannot be done for you, that's for sure. Trading is within you!

So is trading is easy? No it's not, but is 'simple'! With that, you can answer that when you are in the market losing for long, as this market observer can point out. Trading can be done based from your own market observation, reading the minds of the market...as that famous quote from the market speculators always emphasized. It's about understanding the whole market structure, it's about your own way of interpreting how you can participate based from your own way of learning, it is not about how other people's (traders) way of trading - it is about your own way.

It is not how 'sophisticated' you are, I mean those indicators, it is not about how you fill your chart with lots of indicators which 'most' don't understand - only the one who invented it can understand, or if they can/do (I mean the inventor itself), I'm sure they don't use it either (sorry folks). It is not about that vwap...profiling... fibs...tick...rsi...or whatever...those are all for sophistication, the more you 'sophisticate' your trading, the more you make it hard to make a trade, is that not 'common sense'?

So make a trade based from your own way, don't trade other trader's way, because at the end of the day, when the market opens, everybody are scrambling to make green bucks. The best way is to collate great trading ideas, mold them into your own, implement it the way you understand it based from your own way of understanding how the market works, the big question there is 'how the market works', that will be your problem to solve, that will take a long time to 'dig' your 'bonehead'.

Based from my years of losing, desperation, frustration, name (I mean the hardship in the market) it I experienced it, trading the market is simple...but it's NOT THAT EASY!

Friday, June 28, 2024

Last minute trade

Friday's market not quite interesting, an ugly chart trading day.

Did last minute trade and able to get back early loss.

Trade MNQU4 in the futures markets (chart is QQQ, similar pattern).

Daily Trading Notes

Following are notes to be aware of when confronting the market

1. Don't impose will in the market. Trade what charts do.

2. Wait for the right timing/pattern to emerge. Don't manufacture trades.

3. Gad'm shit - cannot trade the market everyday!

4. Add to winning trades, not to losing trades.

5. Don't trade/send money to suicide mission.

6. Don't just trade for the sake of trading.

7. Market doldrums - 8:30am - 11:30am. PT (need to be aware of, market is taking lunch break)

8. Trade smarter not harder. Focus on the process.

9. Trade with an edge. Trade with sense.

10. Trade what you see.

11. Be accountable. Protect capital.

12. Be patient. Wait for the right trade setup.

13. Be consistent. Be selective.

14. Cut losses. Always put stop.

15. Job is not trading. Job is to make money.

Trade 'in-between'

In trading the market, impossible to buy at the bottom and sell at the top.

The best way to trade is 'in-between'.

Thursday, June 27, 2024

Trade with an edge - to make a good trade and make money

There lots of ways to make money trading the stock market, and the opportunity to make money is always there.

The money is always there ready to grab it - if you know and learn how the market works, you can earn a living trading the market.

It's not about having much capital, it's about having understanding how to make trades with an 'edge'.

Edge is about the knowledge and understanding the market movement relative to the technical charts.

And having familiarity with the trading instruments will have an advantage - futures/stocks/cryptos/forex.

Once you develop a familiarity based from your own understanding, then you can have the edge.

Futures markets especially the indices preferably offers good opportunity.

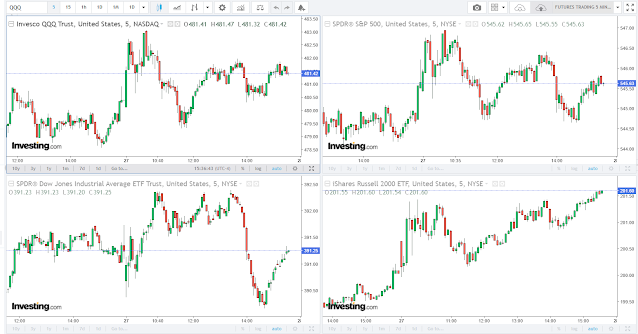

They correlate the main charts below.

Futures markets especially the micros offers low margins and you can trade them with minimal capital.

Friday, June 21, 2024

Trading for an 'Adventurer Trader' - lessons from an ordinary self-taught individual home trader

Been trading for quite some time, on and off, through the years of self learning, I find that trading is all in 'yourself'.

Cannot be like those traders in you tubers and in the trading books - they're all 'myth'.

Even if you have all the ideas in trading and have much capital, but if you don't have the self belief and thorough examination of yourself - cannot be done positively.

All you will have is frustrations, denials, searching/researching of ways to become 'profitable', and 'become successful' - like those in the You Tube's - mind you, that will just be a dream (well - better to have a 'dream' than not to have one😏).

Have read a lot of books, name it and I have read them most if not all, including those 'scratch books' in kindles, they won't help, all you will get are just words/sentences/techniques/strategy/quotes, whatever - that will just leave you spinning around and continue thinking/implementing ideas you got/learned, not knowing you did everything, and for years, still chasing that 'that' dream someday you can make it.

Not ever, you cannot make it!

Unless you have that 'third paragraph' sentence of this post - it will just be a waste of time/money/effort - and you will remain 'gambling' your intelligent mind forever and you might get a 'divorced' notice from your princes/pals/love ones😝.

Monday, June 3, 2024

Friday, May 31, 2024

Monday, May 27, 2024

5/28-31/2024 Observe & Trade stocks

Charts below offers new trade opportunity for the week, let's keep an eye Tuesday price movement/signal and enter the best price we think will give us an edge, once we get 2+ dollar gain, exit the trade, we have 8 instruments to select the very best bet we can Observe & Trade this week! AZN; CHRW; FORM; KTB; NEE; PEG; RDNT; TNDM

what is the market and why

As exposed in the stock market (wall street) in an individual manner thru own reading/research, find it fascinating that there is an opportunity to earn something through your own way.

As new technology being created and introduced, participating in the stock market gives every ordinary individual an opportunity to earn something as long as you know and learn how it works.

Most legendary/wealthy market veterans who've been conquering the stock market world for sometime, 'discourages' new entrants participating in their elite world (since before only them who has the privilege to participate), they monopolized the market. And most even in their 90's are still in the market and don't want to 'retire' - they still want to control the main money, that's why ordinary people are struggling because they control most of the wealth?

They don't like new stock market platform that offers few dollars to play/trade/invest the stock market.

It's time for the tiktokkers/redditors to get involved and get/claim even a fraction from the elite wealth?😅

Friday, May 24, 2024

DOGE 2024 breakout

chart below seems the reminiscences of 2021 when DOGE wag the tail hard and made a breakout to the top, let's wait till the end of 2024

Wednesday, May 22, 2024

CAVA the next CMG

there's possibility that CAVA (CAVA ) is the next CMG (CMG), take a look at the brand and see/evaluate the possibility

just pile $10 doge every week till end of 2024?

still eying the above per the chart below, is it going to go up and and beat the previous top? don't know, but the triangle seems probable, just pile $10 per week from Robinhood platform, equivalent to a cup of grande SBUX coffee, if you drink SBUX coffee everyday, skip on Friday and buy $10 DOGE from Robinhood, and find out the results till the end of 2024 😇

Tuesday, May 21, 2024

trading the hype

let's see if it works getting involved trading the hype, it's not about value, it's about making something different, taking the risk and evaluating the chance or opportunity

Monday, April 1, 2024

still a buy for DOGE

Per chart below, DOGE still a buy, probable to beat the 2021 May price of $0.65.

Still piling $30 per week from Robinhood platform.

PLTR Long

100shares today for long trade, forming cup with a handle or inverse head and shoulder pattern, it all depends interpreting technical chart. Target in the $40 level. Per observation, it went up on a big move (a big buy on volume), stay idle for days, might consolidate further, but it might possibly go up with the trend.

Sunday, March 31, 2024

Eyeing RDDT

Eyeing the above on the price level below, usually IPO stock drops and leveled for month or so, then they surge after, let see if we can stake and get some good outcome in a month or so.

Friday, March 29, 2024

barking DOGE

Made decent amount early of 2021 as most doubts about the opportunity from DOGE, but it's not about value in the market, it's about making money.

While the crowds are in frenzy mode and started buying while DOGE going up - I'm already out, guess what, it drops after, and stagnant for the rest of two years or so (exactly three years as of today).

While DOGE in the sleeping mode, started piling up.

Now DOGE starting to bark again, been watching closely the previous top and see if it can beat the previous high.

If it does, will get out, but need to monitor and see how the market crowds behavior shows - need to read the minds of the market as they say.

Remember, in the market, it's hard to buy at the bottom and sell at the top - in between the market is the way to go and make decent amount.

Thursday, March 28, 2024

MRNA Bottom Buy

Trading/investing?😅 MRNA per the chart below.

100 shares at $108.00 3/28/2024.

Let's see in a year or so😇

Tuesday, March 26, 2024

Monday, December 4, 2023

Guide to day trading MNQ micro futures

Showing here a trading guide how to trade emicro futures in Tradovate, where you can put small amount ($200) to start trading and make small amount at your own time. Doing this kind of trades if you master your craft and your emotions, you can do trade for a living.

Chart below is a 5minute chart, but to get the right trade, need to monitor on multi time frame chart, say 1 minute chart to get the best entry and exit trade.

See example of trading platform.

Process of trading though take a lot of time to study and learn, but continuous reading and learning will help in the long run and patience reading the minds of the markets will get you there, though mastering one self and emotion controls is the most important.

There lots of tools and resources out there to learn, they're all there, money is always there in the market, just get some/take advantage that Mr. Market always offer, a tiny fraction from him to 'steal' is not bad😏

BTC - area to buy

Weekly chart below where BTC on consolidation mode - where the best area to get involved, though after the fact, a reference where possible amount is doubled if it was taken advantage?

Friday, August 25, 2023

Wednesday, May 10, 2023

Sunday, April 30, 2023

DOGE Still Not Wagging The Tail

The way the chart looks below, takes time to have something to gain or possibly zilch?

Maybe or maybe not, but something to think of if there are still some players interested to get involved and play with.

As long as there are sites that crypto's being played with, who knows.

Takes time to know.

Wednesday, January 4, 2023

Sunday, December 11, 2022

Friday, December 9, 2022

Main Trading Problem

1. Lack of discipline

2. Not trading rationale

3. Not exiting when the trade not acting well

4. Letting losses that makes account blow up to zero - for the nth time

5. Not learning a lesson - hard headead and bone head

Monday, November 28, 2022

Trading Problem

1. Revenge trading - trying to get back losing trades

2. Irrational trading - not thinking well and not watching/controlling emotion

3. Not sticking to one strategy - not following trading guidelines