Not doing any trading for the market is not giving some opportunities or ideas how to participate.

The market is acting inappropriate (these days?) and its hard to make a conclusive evidence to make a sound judgment how we can react or take action with its bipolar? (as Warren Buffet sometimes referred to?) behavior.

When the market (re)acts that way, so does most of the participants?

I don't know, but when the market is acting like this, the best way for the trader is to stay idle and let the market do what it wants to do.

Have patience and wait until the market settles or when the market becomes rationale.

For today's market, it's still suffering a disorder and (was) not yet diagnosed when or what kind of cure/pill to be given to.

I guess the market needs a tranquilizer to take a breather or the form of recreational medicine (like that one that was ratified/legalized by some states?).

As can be seen from this 5-min. chart (unless you are an HFT's), if you are trading alone as a discretionary, you cannot trade this in comfort? or it will be hard to participate.

I don't know but this is how i can characterized this market as of the moment.

This is also a lesson to learn for the future, since the market as we all know is always acting in an irrational manner.

No doubt about that, we cannot expect the market to act efficiently.

That's why we as traders needs to learn from it and work on our self too.

'Trading is a process of observing the market's action until such a time you can find and form trading ideas and get involved.'**

Tuesday, November 13, 2012

Monday, November 12, 2012

Monday's Trade Setup

The market was on a slow movement today partly because of the holiday (Veteran's Day), most participants are on vacation.

For the trade today, the market seems it will continue its downside momentum when it opened high only to lose its fire and made a flat consolidation below the settlement price.

Opening for an opportunity to buy within the ma's crossover.

The exit is pointed above (with an arrow).

Patience needs to exercise with this kind of trade.

For the trade today, the market seems it will continue its downside momentum when it opened high only to lose its fire and made a flat consolidation below the settlement price.

Opening for an opportunity to buy within the ma's crossover.

The exit is pointed above (with an arrow).

Patience needs to exercise with this kind of trade.

Saturday, November 10, 2012

Friday's Market Action

The market barely risen from its hole last Friday's action.

But at least it had shown a sign of relief that it can bounce back from the grave.

For Friday's trade, a buy in the open and sell below R1 (resistance) is the most appropriate spot to make a profit as shown from this 5-min. chart.

Steve Job's Apple (AAPL) also risen from the dead when it bounced back last Friday's session.

And Facebook (FB) stock needs to face reality that it has a hard time convincing investors to move the stock from its previous IPO price of $40.00 down to its present price of $19.18. I guess its needs fresh ideas to convince this social networking users in a more productive and appropriate manner rather than using it for 'fun'?

But at least it had shown a sign of relief that it can bounce back from the grave.

For Friday's trade, a buy in the open and sell below R1 (resistance) is the most appropriate spot to make a profit as shown from this 5-min. chart.

Steve Job's Apple (AAPL) also risen from the dead when it bounced back last Friday's session.

And Facebook (FB) stock needs to face reality that it has a hard time convincing investors to move the stock from its previous IPO price of $40.00 down to its present price of $19.18. I guess its needs fresh ideas to convince this social networking users in a more productive and appropriate manner rather than using it for 'fun'?

Thursday, November 8, 2012

Thursday's Trade Setup

The market continues to slide down.

The sellers outnumber the buyers and the market is not showing any sign of relief.

For today's market trade, a sell (short) in the open and cover at the close is the best way to make money.

An easy day today to make money trading the market.

The sellers outnumber the buyers and the market is not showing any sign of relief.

For today's market trade, a sell (short) in the open and cover at the close is the best way to make money.

An easy day today to make money trading the market.

Wednesday, November 7, 2012

The Markets After Effect Election

The market reacted sharply from the recent electoral conclusion.

Seems the market did not agree with the election result and the sell off triggered.

All the market indices were all on the selling spree as soon as the market opens and continues till the closed.

I will not be surprised if the market will all break lose come tomorrow's market.

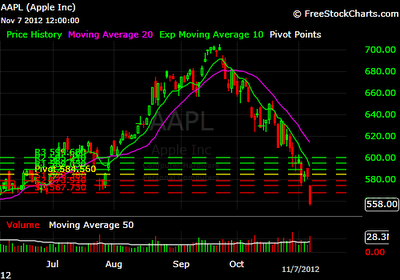

The following charts shows how the market reacted with the recent election.

And the Apple (AAPL) stock is losing its eye from the investor.

Is this the end of cliff for Apple?

Your guess is as good as mine!

Seems the market did not agree with the election result and the sell off triggered.

All the market indices were all on the selling spree as soon as the market opens and continues till the closed.

I will not be surprised if the market will all break lose come tomorrow's market.

The following charts shows how the market reacted with the recent election.

Is this the end of cliff for Apple?

Your guess is as good as mine!

Tuesday, November 6, 2012

Presidential Election Trade Setup

The market was on the uncertain moves early in the open probably because of the presidential election.

I guess the market participants are gauging the trend of the voters who is going to get the majority votes because of the closed contest.

And this chart shows that by the time (around 11:30 am. E.T.) the market rallied, seems the participants had the idea who's going to win.

Let's just wait and see by night time!

For the trade today, I call it the Presidential Election Trade Setup.

Buying at the settlement price when the MA's shows confirmation (arrow) for a long trade.

Exit the trade within the R2 level is the best trade for today considering the market is looking for a certain direction.

No need to wait for the whole market session for it might turn volatile at the latter part because of the election.

Trade safely!

I guess the market participants are gauging the trend of the voters who is going to get the majority votes because of the closed contest.

And this chart shows that by the time (around 11:30 am. E.T.) the market rallied, seems the participants had the idea who's going to win.

Let's just wait and see by night time!

For the trade today, I call it the Presidential Election Trade Setup.

Buying at the settlement price when the MA's shows confirmation (arrow) for a long trade.

Exit the trade within the R2 level is the best trade for today considering the market is looking for a certain direction.

No need to wait for the whole market session for it might turn volatile at the latter part because of the election.

Trade safely!

Sunday, November 4, 2012

The most indebted man in the world owes former employer $6.3 billion

Former financial arbitrage trader Jerome Kerviel is the most indebted man on the planet, owing his former employer $6.3 billion.

The amount Kerviel owes to French bank Societe Generale for fraudulent trades made in 2007 and 2008 would make Kerviel one of the 50 richest people in America if those debts were assets.

But Kerviel cannot even begin paying off his debts until 2015, when he is scheduled to be released from prison. Kerviel recently lost an appeal case in which he argued the corruption at Societe Generale was widespread.

The Atlantic's Matthew O'Brien writes that Kerviel managed €50 billion ($73 billion in unadjusted dollars) worth of unauthorized trades during his tenure at Societe Generale, using a sophisticated scheme of computer hacking and deceptive trades to deceive the bank.

O'Brien writes:

"In plain English, arbitrage just means taking advantage of discrepancies when things should have the same price, but don't. The idea is to buy the cheaper one, sell the more expensive one, and then wait for them to converge. The beauty is it doesn't matter whether markets go up or down--you're both long and short--just that the prices actually converge."

O'Brien spoke with former investment banker and current University of San Diego law professor Frank Partnoy about the logistics of trying to collect $6.3 billion from a single individual.

"Well, he's obviously not going to be able to pay the fine," Partnoy told the Atlantic. "What happened to Kerviel is the financial equivalent of sentencing someone to life plus 100 years. They'll likely reach some kind of agreement where a significant percentage of any money he makes for the rest of his life will be paid into a fund to cover the fine. He'll be like Sisyphus pushing the boulder up the hill every day for the rest of his life."

And while you could debate whether there are better ways for Kerviel to pay back Societe Generale, Partnoy offers a stark comparison to the fines levied against some of the world's largest financial institutions. In 2010, Goldman Sachs agreed to a $550 million settlement with Securities Exchange Commission, paid in part to investors and the U.S. government, which the SEC described as the largest settlement in history against any Wall Street firm.

Subscribe to:

Comments (Atom)