Albert Einstein’s was estimated at 160, Madonna’s is 140, and John F. Kennedy’s

was only 119, but as it turns out, your IQ score pales in comparison with your

EQ, MQ, and BQ scores when it comes to predicting your success and professional

achievement.

IQ tests are used as an indicator of logical reasoning ability

and technical intelligence. A high IQ is often a prerequisite for rising to the

top ranks of business today. It is necessary, but it is not adequate to predict

executive competence and corporate success. By itself, a high IQ does not

guarantee that you will stand out and rise above everyone else.

Research

carried out by the Carnegie Institute of Technology shows that 85 percent of

your financial success is due to skills in “human engineering,” your personality

and ability to communicate, negotiate, and lead. Shockingly, only 15 percent is

due to technical knowledge. Additionally, Nobel Prize winning Israeli-American

psychologist, Daniel Kahneman, found that people would rather do business with a

person they like and trust rather than someone they don’t, even if the likeable

person is offering a lower quality product or service at a higher

price.

With this in mind, instead of exclusively

focusing on your conventional intelligence quotient, you should make an

investment in strengthening your EQ (Emotional Intelligence), MQ (Moral

Intelligence), and BQ (Body Intelligence). These concepts may be elusive and

difficult to measure, but their significance is far greater than

IQ.

Emotional Intelligence

EQ is the most well known of the three, and in brief it is about: being aware of

your own feelings and those of others, regulating these feelings in yourself and

others, using emotions that are appropriate to the situation, self-motivation,

and building relationships.

Top Tip for Improvement: First,

become aware of your inner dialogue. It helps to keep a journal of what thoughts

fill your mind during the day. Stress can be a huge killer of emotional

intelligence, so you also need to develop healthy coping techniques that can

effectively and quickly reduce stress in a volatile situation.

Moral

Intelligence

MQ directly follows EQ as it deals with your

integrity, responsibility, sympathy, and forgiveness. The way you treat yourself

is the way other people will treat you. Keeping commitments, maintaining your

integrity, and being honest are crucial to moral intelligence.

Top

Tip for Improvement: Make fewer excuses and take responsibility for your

actions. Avoid little white lies. Show sympathy and communicate respect to

others. Practice acceptance and show tolerance of other people’s shortcomings.

Forgiveness is not just about how we relate to others; it’s also how you relate

to and feel about yourself.

Body

Intelligence

Lastly, there is your BQ, or body intelligence, which reflects what you know

about your body, how you feel about it, and take care of it. Your body is

constantly telling you things; are you listening to the signals or ignoring

them? Are you eating energy-giving or energy-draining foods on a daily basis?

Are you getting enough rest? Do you exercise and take care of your body? It may

seem like these matters are unrelated to business performance, but your body

intelligence absolutely affects your work because it largely determines your

feelings, thoughts, self-confidence, state of mind, and energy

level.

Top Tip For Improvement: At least once a

day, listen to the messages your body is sending you about your health. Actively

monitor these signals instead of going on autopilot. Good nutrition, regular

exercise, and adequate rest are all key aspects of having a high BQ. Monitoring

your weight, practicing moderation with alcohol, and making sure you have down

time can dramatically benefit the functioning of your brain and the way you

perform at work.

What You Really Need To

Succeed

It doesn’t matter if you did not receive the best

academic training from a top university. A person with less education who has

fully developed their EQ, MQ, and BQ can be far more successful than a person

with an impressive education who falls short in these other categories.

Yes, it is certainly good to be an intelligent, rational thinker and have a high

IQ; this is an important asset. But you must realize that it is not enough. Your

IQ will help you personally, but EQ, MQ, and BQ will benefit everyone around you

as well. If you can master the complexities of these unique and often

under-rated forms of intelligence, research tells us you will achieve greater

success and be regarded as more professionally competent and capable.

'Trading is a process of observing the market's action until such a time you can find and form trading ideas and get involved.'**

Wednesday, May 9, 2012

Wednesday Trade Setup

The market gap down in the open but recover before noon time.

As if it formed a cup with a handle pattern.

To enter a long trade, the arrow as shown in the circle area is the best location to put the entry.

As if it formed a cup with a handle pattern.

To enter a long trade, the arrow as shown in the circle area is the best location to put the entry.

Tuesday, May 8, 2012

Tuesday Trade Setup

The market recovered in the midday trading when it drops in the open.

It formed a wide "w" pattern, a sign that it might recover from its slumped.

Being patient in the market waiting for the opportunities to pop pays a big part.

Like this one from the QQQ etf's which is the equivalent of the NQ Futures.

The best entry for a long trade is at the lower arrow and can be exited from the pivot point.

It formed a wide "w" pattern, a sign that it might recover from its slumped.

Being patient in the market waiting for the opportunities to pop pays a big part.

Like this one from the QQQ etf's which is the equivalent of the NQ Futures.

The best entry for a long trade is at the lower arrow and can be exited from the pivot point.

Monday, May 7, 2012

Monday's Trading

The market barely made a move today for it's Monday, a day participants starts to gauge each others throat where the markets headed.

It consolidates on a choppy range, but the bulls somewhat looking for an upper hand.

Other than the news coming from overseas, the market is just waiting for any favorable news to make its move.

Don't see any probable setups from the QQQ (NQ) today, other than to scalp the overall market index.

Let's see for the coming days if there will be a jumper trade, but it usually happened in the overnight session.

Unless you watch the market like a hawk in the wee hours of the Globex session, you cannot catch the real meat.

After that, the regular open is the real hard battle where the pros always makes the action to profit.

It consolidates on a choppy range, but the bulls somewhat looking for an upper hand.

Other than the news coming from overseas, the market is just waiting for any favorable news to make its move.

Don't see any probable setups from the QQQ (NQ) today, other than to scalp the overall market index.

Let's see for the coming days if there will be a jumper trade, but it usually happened in the overnight session.

Unless you watch the market like a hawk in the wee hours of the Globex session, you cannot catch the real meat.

After that, the regular open is the real hard battle where the pros always makes the action to profit.

Saturday, May 5, 2012

Friday's Trade Setup

The market continues to go down and most participants are taking profit.

Looks like the Wall Street passage, "sell in May and go away" is now on-going?

I guess that's what the chart shows (below).

In this no-brainer trade, sell in the open and cover in the close is the typical Wall Street modus operandi.

Friday's market activities is all about distribution.

The bulls are all on the run and the bears are celebrating in total pandemonium.

I suspect it will be the bears that will control the market in the days to come.

Unless the bulls can take more print money from Uncle Sam to buy the market, it might struggle further.

Let's see how the long term investors reaction.

As for traders, let's take all the opportunities that the market offers on a daily basis.

Looks like the Wall Street passage, "sell in May and go away" is now on-going?

I guess that's what the chart shows (below).

In this no-brainer trade, sell in the open and cover in the close is the typical Wall Street modus operandi.

Friday's market activities is all about distribution.

The bulls are all on the run and the bears are celebrating in total pandemonium.

I suspect it will be the bears that will control the market in the days to come.

Unless the bulls can take more print money from Uncle Sam to buy the market, it might struggle further.

Let's see how the long term investors reaction.

As for traders, let's take all the opportunities that the market offers on a daily basis.

Thursday, May 3, 2012

NQ (QQQ) Thursday Trade Setup

The market went down today and shows some selling pressure.

It stays sideways after the selling pressure from the open and went down hard as show from this 5-min. chart.

Sell short is the trade of the day as shown from the top arrow with the cover below.

It stays sideways after the selling pressure from the open and went down hard as show from this 5-min. chart.

Sell short is the trade of the day as shown from the top arrow with the cover below.

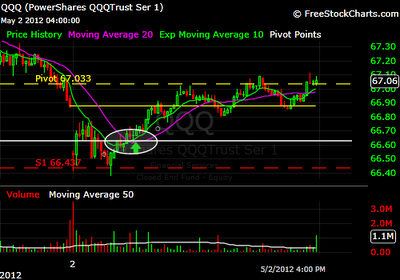

NQ (QQQ) Wednesday Trade Setup

The market open below yesterday's open but recovered after an hour or so.

The bears run out of support and most participants revert to the bulls side and the market turn upside.

Shown is the 5-min. chart with the entry setup pointed in an arrow at the bottom.

Notice the big green candle with a long wick tail at the bottom showing the market is on the reverse mode.

Trade what you see as the saying goes.

Exit the trade before the close and enjoy your profit!

The bears run out of support and most participants revert to the bulls side and the market turn upside.

Shown is the 5-min. chart with the entry setup pointed in an arrow at the bottom.

Notice the big green candle with a long wick tail at the bottom showing the market is on the reverse mode.

Trade what you see as the saying goes.

Exit the trade before the close and enjoy your profit!

Subscribe to:

Comments (Atom)