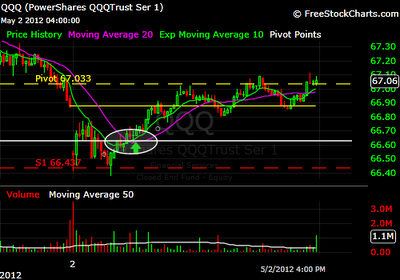

The market gap down in the open but recover before noon time.

As if it formed a cup with a handle pattern.

To enter a long trade, the arrow as shown in the circle area is the best location to put the entry.

'Trading is a process of observing the market's action until such a time you can find and form trading ideas and get involved.'**

Wednesday, May 9, 2012

Tuesday, May 8, 2012

Tuesday Trade Setup

The market recovered in the midday trading when it drops in the open.

It formed a wide "w" pattern, a sign that it might recover from its slumped.

Being patient in the market waiting for the opportunities to pop pays a big part.

Like this one from the QQQ etf's which is the equivalent of the NQ Futures.

The best entry for a long trade is at the lower arrow and can be exited from the pivot point.

It formed a wide "w" pattern, a sign that it might recover from its slumped.

Being patient in the market waiting for the opportunities to pop pays a big part.

Like this one from the QQQ etf's which is the equivalent of the NQ Futures.

The best entry for a long trade is at the lower arrow and can be exited from the pivot point.

Monday, May 7, 2012

Monday's Trading

The market barely made a move today for it's Monday, a day participants starts to gauge each others throat where the markets headed.

It consolidates on a choppy range, but the bulls somewhat looking for an upper hand.

Other than the news coming from overseas, the market is just waiting for any favorable news to make its move.

Don't see any probable setups from the QQQ (NQ) today, other than to scalp the overall market index.

Let's see for the coming days if there will be a jumper trade, but it usually happened in the overnight session.

Unless you watch the market like a hawk in the wee hours of the Globex session, you cannot catch the real meat.

After that, the regular open is the real hard battle where the pros always makes the action to profit.

It consolidates on a choppy range, but the bulls somewhat looking for an upper hand.

Other than the news coming from overseas, the market is just waiting for any favorable news to make its move.

Don't see any probable setups from the QQQ (NQ) today, other than to scalp the overall market index.

Let's see for the coming days if there will be a jumper trade, but it usually happened in the overnight session.

Unless you watch the market like a hawk in the wee hours of the Globex session, you cannot catch the real meat.

After that, the regular open is the real hard battle where the pros always makes the action to profit.

Saturday, May 5, 2012

Friday's Trade Setup

The market continues to go down and most participants are taking profit.

Looks like the Wall Street passage, "sell in May and go away" is now on-going?

I guess that's what the chart shows (below).

In this no-brainer trade, sell in the open and cover in the close is the typical Wall Street modus operandi.

Friday's market activities is all about distribution.

The bulls are all on the run and the bears are celebrating in total pandemonium.

I suspect it will be the bears that will control the market in the days to come.

Unless the bulls can take more print money from Uncle Sam to buy the market, it might struggle further.

Let's see how the long term investors reaction.

As for traders, let's take all the opportunities that the market offers on a daily basis.

Looks like the Wall Street passage, "sell in May and go away" is now on-going?

I guess that's what the chart shows (below).

In this no-brainer trade, sell in the open and cover in the close is the typical Wall Street modus operandi.

Friday's market activities is all about distribution.

The bulls are all on the run and the bears are celebrating in total pandemonium.

I suspect it will be the bears that will control the market in the days to come.

Unless the bulls can take more print money from Uncle Sam to buy the market, it might struggle further.

Let's see how the long term investors reaction.

As for traders, let's take all the opportunities that the market offers on a daily basis.

Thursday, May 3, 2012

NQ (QQQ) Thursday Trade Setup

The market went down today and shows some selling pressure.

It stays sideways after the selling pressure from the open and went down hard as show from this 5-min. chart.

Sell short is the trade of the day as shown from the top arrow with the cover below.

It stays sideways after the selling pressure from the open and went down hard as show from this 5-min. chart.

Sell short is the trade of the day as shown from the top arrow with the cover below.

NQ (QQQ) Wednesday Trade Setup

The market open below yesterday's open but recovered after an hour or so.

The bears run out of support and most participants revert to the bulls side and the market turn upside.

Shown is the 5-min. chart with the entry setup pointed in an arrow at the bottom.

Notice the big green candle with a long wick tail at the bottom showing the market is on the reverse mode.

Trade what you see as the saying goes.

Exit the trade before the close and enjoy your profit!

The bears run out of support and most participants revert to the bulls side and the market turn upside.

Shown is the 5-min. chart with the entry setup pointed in an arrow at the bottom.

Notice the big green candle with a long wick tail at the bottom showing the market is on the reverse mode.

Trade what you see as the saying goes.

Exit the trade before the close and enjoy your profit!

Friday, April 27, 2012

ES Setup Trade

The market made a tight consolidation today, and made a nice entry setup from this 5-min. chart.

Being patient in finding and waiting for a high probable setup can be a profitable trade.

Like this one!

Being patient in finding and waiting for a high probable setup can be a profitable trade.

Like this one!

Subscribe to:

Comments (Atom)