Early trade in the open can make you a good profit if you can capitalize on the price action.

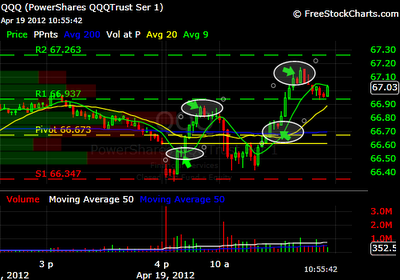

Showing the 2-min. chart of the etf QQQ similar to the Nasdaq NQ futures the two trades.

'Trading is a process of observing the market's action until such a time you can find and form trading ideas and get involved.'**

Thursday, April 19, 2012

Wednesday, April 18, 2012

YM Trade Setup

The market made a choppy move today for it run out of gas from yesterday's breakaway.

And also due to some unfavorable earnings reports from other leading stocks.

Showing here an entry setup for a long trade.

The 3-min. chart here from the YM futures market shows an interesting pattern for a bullish trade.

A mini cup and a handle formation.

The entry is at the lower arrow and just monitor it till you meet your desired profit.

And also due to some unfavorable earnings reports from other leading stocks.

Showing here an entry setup for a long trade.

The 3-min. chart here from the YM futures market shows an interesting pattern for a bullish trade.

A mini cup and a handle formation.

The entry is at the lower arrow and just monitor it till you meet your desired profit.

Tuesday, April 17, 2012

The market made a stunning comeback today after weeks of getting pummeled by the bears.

A typical buy in the open and sell in the close is the no-brainer trade today.

Just buy any of the three index below in the futures market and you can close your eyes and make money the whole trading day.

Sometimes the market will give you surprises that you won't have a hard time looking for trades.

It's just right there in front of your screen and just take the money and put it in your wallet.

Easy trading in today's market!

A typical buy in the open and sell in the close is the no-brainer trade today.

Just buy any of the three index below in the futures market and you can close your eyes and make money the whole trading day.

Sometimes the market will give you surprises that you won't have a hard time looking for trades.

It's just right there in front of your screen and just take the money and put it in your wallet.

Easy trading in today's market!

Sunday, April 15, 2012

NQ Trade Setup

Showing some trade setups that were conducted last Friday's trading session.

The entry was at the lower arrow and the exit was at the upper arrow.

Nice breakout from the entry but was short lived.

After that it stays sideways most of the day until it drops late in the close.

The reason for the entry trade is the formation of the two big green bar from the bottom.

Notice that they are almost flat from the low of the day and by reading the price action, you can put an entry for a long trade.

It formed a failed cup with a handle pattern or a deep saucer pan minus the handle.

The entry was at the lower arrow and the exit was at the upper arrow.

Nice breakout from the entry but was short lived.

After that it stays sideways most of the day until it drops late in the close.

The reason for the entry trade is the formation of the two big green bar from the bottom.

Notice that they are almost flat from the low of the day and by reading the price action, you can put an entry for a long trade.

It formed a failed cup with a handle pattern or a deep saucer pan minus the handle.

Saturday, April 14, 2012

I'm Back...

Been a while not posting and I'm back!

Quite busy doing trades practicing the return of the market's surge.

Been trading the NQ (Nasdaq futures) for a change but I'm a little bit late trading it.

It's been on a roll since the first day of the year and the way I can see from this daily chart is that it's starts to make a pause.

It's like a runner who's on the lead for so long and starts to run out of energy.

It might be the return of the volatility come the next trading months?

The tech stocks are on a roll probably because of the iPad/iPhone mania.

Quite busy doing trades practicing the return of the market's surge.

Been trading the NQ (Nasdaq futures) for a change but I'm a little bit late trading it.

It's been on a roll since the first day of the year and the way I can see from this daily chart is that it's starts to make a pause.

It's like a runner who's on the lead for so long and starts to run out of energy.

It might be the return of the volatility come the next trading months?

The tech stocks are on a roll probably because of the iPad/iPhone mania.

Monday, April 9, 2012

I saw a nice, concise post by Greg Harmon of Dragonfly Capital this weekend on the topic of "What is Technical Analysis" and I thought I'd bring it over, both to educate readers who might not be familiar with the framework and to have it somewhere I can refer to it in the future! He does a great job if explaining not only what it is at the 40,000 point foot of view but what it is not – and I often take for granted the fact that many people who stop by the website have never heard of the concept or only vaguely know why anyone would or would not use it.

In many ways I think of technical analysis ("TA") as hocus pocus – not because it is 'magic', but due to the fact the reason it gives any proposed advantage is because so many other people use it. Hence it tends to self reinforce as more people and institutions (over the years) use it. To that end, why does a 200 day moving average matter… but not so a 137 day (or 253 day) average? Perhaps Fibonacci retracements can be better argued as not being "hocus pocus" as they are found widely through other disciplines but you get the drift; of course this is only my opinion and I am sure could be argued strenuously by others.

"TA" does not seem to be used very much at all anywhere in the mutual fund world (I don't think I've read more than 5-6 stories in 15+ years about it's use in the mutual fund world) but is much more prominent among the hedge fund and non mutual fund institutional set. While some people ONLY use technical analysis and nothing else, I think it's best used as another tool on the tool belt, but to each their own.Via Greg:

What it is

Technical Analysis at its base is an interpretation of price action plain and simple. It can be interpreted in many ways. Some use resistance and support levels based upon previous points where an asset has struggled to move higher or lower. Some use trend lines that rise or fall to glean insights into changes in buying and selling sentiment. Many look at historical patterns like triangles, wedges and channels to try to estimate how prices will react going forward. Still others look for cycles and patterns like Fibonacci ratios, seasonal factors, election cycles and longer cycles like Elliott Waves and the Kondratieff Wave for an explanation. It can get quite complex with derivatives of the price action in momentum oscillators and volatility measures. Volume can play a role as well as an indicator appetite. But no matter what tools they use all technicians are looking for an edge to give a good entry or exit on a risk reward basis for a deployment of capital. A risk framework to design a trading strategy around. A forecast. A possible future with contingencies.What it is not

This is a subtlety many that do not practice TA fail to grasp. A possible future with contingencies. There is nothing about certainty in that statement. TA is not a road map. It does not point to an outcome. Probability is more like it. It is not fixed in time either. The read can change with changes in the price action, expected or unexpected. Nothing is certain. It can change with time. The closest thing to certainty in the TA world are horizontal support and resistance lines. They do not change, but they are also not made of concrete. Price can just as easily blow right through them or gap over them as it can be halted. And what has worked in the past may or may not work in the future.Sunday, April 8, 2012

Are You A Victim Blamer?

by: Bill Zimmer

Thursday, April 5th, 2012 at 10:31 am

Impulsive people have a way of reaching conclusions and taking action that, in comparison, with normal deliberations and intentions would be considered impaired. Acting on a whim, giving in to temptation, doing what you have told yourself, time and again not to do, is acting impulsively. Impulsive people are not self-confident but simply hope and wish for results. Quite simply they have no long-term goals, within which trades and management should be planned, only immediate urges. Their behavior is abrupt and unplanned. The time between thought and action is very brief.

The net outcome of unplanned behavior is when failure occurs, the process of analyzing bad trades malfunctions. The person cannot accrue effective lessons from the loss. Without a plan, impulsive people can’t develop methods to determine what works and what doesn’t. They can’t understand why they failed.

Impulsive people are also deficient in a certain method of thought process. Normal people weigh, analyze, research and develop an initial impression. Impulsive people guess and bet heavily without much thought. Impulsive people are often victim blamers. The results are reflective of character and personality, not intelligence.

Victim blamers tend to interpret anything in life that doesn’t go their way as somehow aimed against them, believing somebody or something is working against their welfare. It may be a boss, a girlfriend or an entity such as a company or the government. Or it may be outside forces such as “bad luck,” “nature,” “evil forces”. They never learned to assume personal responsibility for their own actions vs. blaming others. While everyone tends to lapse into blaming others at least sometimes for their misfortune, this trading type makes blaming their primary defense mechanism to deflect their own sense of urgency.

Because they are looking for someone to blame for their investments that lose money, they are among those most in favor of intense governmental investigation and prosecution of market manipulation of any kind. With each fresh uncovering of company accounting fraud, brokerage-analyst duplicity, insider trading or any other type of market manipulation, they smile and say, “See, I told you they’re all out to get us!” But this only tends to make them feel more helpless and assume less responsibility for their own investing decisions. If you have a tendency to be impulsive, the cure is to put together realistic and sound goals along with a realistic trading plan. Make yourself work towards the attainment of those goals by not violating the rules of your trading plan.

Subscribe to:

Comments (Atom)