'Trading is a process of observing the market's action until such a time you can find and form trading ideas and get involved.'**

Thursday, November 24, 2011

Fearful European bankers see little to be thankful for

While the United States turns its back on global gloom for a long holiday weekend, a failed German bond auction has finally brought home to Europeans the realization that nowhere is safe.

"It's as grim as hell. The only good thing is now everyone knows it's as grim as hell," one pale commuter was overheard telling a disheveled-looking colleague on their early-morning Tube ride into London's Canary Wharf financial hub.

Until this week Germany -- Europe's largest economy, with a hard line on austerity -- had been seen as the euro zone's last refuge and a source of comfort for the army of bankers, fund managers and traders caught in Europe's deepest financial crisis since World War Two.

Then came Wednesday's bond auction, in which Berlin found no buyers for almost half of a 6 billion euro 10-year bond offering at a record low 2.0 percent interest rate.

"Yesterday's German bund auction was a clear example that things they thought were on the periphery are now in the core... it's time to do something," said Thomas Becket, chief investment officer at funds firm Psigma Investment Management.

Bond investors have fled, interbank lending is drying up again and questions are being asked about the stability of the region's banking sector: while Americans tuck into turkeys, Europeans are finding life more frightening than festive.

One senior European banker, who declined to be named, said many of his colleagues had been "crisis-deniers" and were given false hope of a rapid return to big bonuses and job security by the significant economic rally in 2009.

"What they are realizing now, and it's even more brutal for them, is that this is in fact the new normal, that the industry is going back to what it was in the early 2000s," the banker said, adding that the recent round of layoffs had cut much deeper than the last, because no bank was hiring.

WORSE THAN LEHMAN?

The quarter following the September 2008 collapse of U.S. investment bank Lehman Brothers has long since served as the benchmark for the lowest ebb of banker morale in living memory, but consensus is quickly shifting.

At a capital markets conference hosted by IFR at the Thomson Reuters' London headquarters on Thursday, bankers and investors exchanged sober greetings like "How are you holding up?" and "are you surviving ok?."

When an attendee expressed surprise at seeing an acquaintance at the event, the fellow delegate drily replied: "It is not like any of us have much to do at the moment."

Depression and stress are sweeping the financial sector, industry sources say, as working weeks gobble up weekends and bankers and traders nervously accept they don't know whether they will still be employed in the New Year.

"You can spend more time on pitching and marketing but sometimes you have to stop and say, 'there is nothing we can do.' And you see people just leave (to go home)," one debt capital markets banker said.

This rock-bottom sentiment can be observed right across the financial sector.

Money men once cynically described as the "Masters of the Universe" are feeling powerless to influence, much less prevent a potential unraveling of Europe's monetary union -- a calamity that would define their generation, possibly even the century.

"You have to think that eventually the penny will drop and they'll have to do something. But...quite sensible people were sitting around in 1914 and saying Europe's not going to tear itself apart over some arch duke being shot by a Serbian fanatic, is it?," said Rob Burgeman, a director at British investment manager Brewin Dolphin.

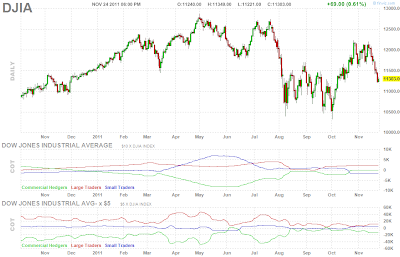

A sheep? form-a-like for the Dow chart?

I had been noticing this form-a-like from the Dow the past few days.

Though the market is struggling to get its traction for a breakout, its been on the downtrend/sell off the past two weeks now.

Just for my own thoughts for noticing the form-a-like sheep because of the approaching holidays.

Maybe the market will surge before the Christmas?, who knows.

But the way I psych the market, seems it will.

The market is also an exercise in psychology and human emotions, I bet the market might get its bearing before the year ends.

See the charts and form your own visualization.

I had been noticing this form-a-like from the Dow the past few days.

Though the market is struggling to get its traction for a breakout, its been on the downtrend/sell off the past two weeks now.

Just for my own thoughts for noticing the form-a-like sheep because of the approaching holidays.

Maybe the market will surge before the Christmas?, who knows.

But the way I psych the market, seems it will.

The market is also an exercise in psychology and human emotions, I bet the market might get its bearing before the year ends.

See the charts and form your own visualization.

Wednesday, November 23, 2011

World stocks hit by signs of slowdown in China, US

World stocks down after US cuts 3Q growth estimate, survey shows China manufacturing slowdown

BANGKOK (AP) -- World stocks fell Wednesday after a survey showed China's

factories are cutting production and the U.S. lowered its third quarter growth

estimate, adding to pessimism from Europe's simmering debt crisis.

Benchmark oil fell below $97 a barrel while the dollar strengthened against the euro and held steady against the yen.

European shares sank in early trading. Britain's FTSE 100 fell 0.3 percent to 5,191.94 and Germany's DAX lost 0.4 percent to 5513.08. France's CAC-40 was down 1 percent to 2,844.49.

Futures augured a lower open on Wall Street. Dow Jones industrial futures lost 0.7 percent to 11,362 while S&P 500 futures slipped 0.8 percent to 1,173.10.

Asian stock markets posted broad losses earlier in the day, hit by the signs of weakness in the world's two biggest economies. The U.S., a major market for Asia's exporters, grew at a 2 percent annual rate from July through September, down from an initial estimate of 2.5 percent. China, meanwhile, suffered a fall in manufacturing activity in November, according to a preliminary survey.

Hong Kong's Hang Seng slid 2.1 percent to 17,864.43. South Korea's Kospi lost 2.4 percent to 1,783.10 and Australia's S&P/ASX 200 shed 2 percent to 4,051. Mainland China's Shanghai Composite Index fell 0.7 percent to 2,395.07, posting its sixth straight session of losses. Japanese stock markets were closed for a public holiday.

Jackson Wong, vice president of Tanrich Securities in Hong Kong, said already weak market sentiment was further dampened by HSBC's China manufacturing index showing a contraction in activity.

The manufacturing gauge fell to 48 in November from 51 in October — its sharpest fall since March 2009. A reading below 50 indicates contraction from the previous month, but the index often undergoes significant revision from its preliminary level.

"The market is still waiting for some kind of price catalyst to bound back. Otherwise, we still trend down bit by bit until something happens," Wong said.

Higher borrowing costs for Spain, meanwhile, renewed worries about Europe's debt crisis. The higher rates suggest that investors are still skeptical that the country will get its budget under control despite a new government coming to power this week.

Investors have been worried that Spain could become the next country to need financial support from its European neighbors if its borrowing rates climb to unsustainable levels.

Greece was forced to seek relief from its lenders after its long-term borrowing rates rose above 7 percent. The rate on Spain's own benchmark 10-year bond is dangerously close to that level, 6.58 percent.

Underscoring jitters was the lack of market reaction to an announcement by the International Monetary Fund that it will provide quick cash on flexible terms to countries facing sudden financial stress.

"Failure of this news to result in significant gains across markets shows just how cautious investors are," Stan Shamu of IG Markets in Melbourne said in a report.

Concerns remain that Europe's debt crisis is pushing the region toward recession, which would slow industrial activity in countries around the world that export to Europe.

Australian resource shares took a big hit after the country's House of Representatives approved a law imposing a windfall profits tax on big mining companies. The Senate is expected to endorse the measure in early 2012.

BHP Billiton, the world's largest mining company, fell 3.1 percent. Rival Rio Tinto lost 3.4 percent and Energy Resources of Australia plummeted 5.9 percent.

In Seoul, auto parts maker Mando rose 2.6 percent on hopes that a free trade pact between South Korea and Washington would boost its earnings, Yonhap News Agency reported.

On Tuesday, the Dow Jones industrial average lost 0.5 percent to close at 11,493.72. The Standard & Poor's 500 fell 0.4 percent to 1,188.04. The Nasdaq composite fell 0.1 percent to 2,521.28.

Benchmark oil for January delivery was down $1.04 to $96.97 a barrel in electronic trading on the New York Mercantile Exchange. The contract rose $1.09 to finish at $98.01 per barrel on the Nymex on Tuesday.

In currencies, the euro fell to $1.3457 from $1.3509 late Tuesday in New York. The dollar was little changed at 76.98 yen.

Benchmark oil fell below $97 a barrel while the dollar strengthened against the euro and held steady against the yen.

European shares sank in early trading. Britain's FTSE 100 fell 0.3 percent to 5,191.94 and Germany's DAX lost 0.4 percent to 5513.08. France's CAC-40 was down 1 percent to 2,844.49.

Futures augured a lower open on Wall Street. Dow Jones industrial futures lost 0.7 percent to 11,362 while S&P 500 futures slipped 0.8 percent to 1,173.10.

Asian stock markets posted broad losses earlier in the day, hit by the signs of weakness in the world's two biggest economies. The U.S., a major market for Asia's exporters, grew at a 2 percent annual rate from July through September, down from an initial estimate of 2.5 percent. China, meanwhile, suffered a fall in manufacturing activity in November, according to a preliminary survey.

Hong Kong's Hang Seng slid 2.1 percent to 17,864.43. South Korea's Kospi lost 2.4 percent to 1,783.10 and Australia's S&P/ASX 200 shed 2 percent to 4,051. Mainland China's Shanghai Composite Index fell 0.7 percent to 2,395.07, posting its sixth straight session of losses. Japanese stock markets were closed for a public holiday.

Jackson Wong, vice president of Tanrich Securities in Hong Kong, said already weak market sentiment was further dampened by HSBC's China manufacturing index showing a contraction in activity.

The manufacturing gauge fell to 48 in November from 51 in October — its sharpest fall since March 2009. A reading below 50 indicates contraction from the previous month, but the index often undergoes significant revision from its preliminary level.

"The market is still waiting for some kind of price catalyst to bound back. Otherwise, we still trend down bit by bit until something happens," Wong said.

Higher borrowing costs for Spain, meanwhile, renewed worries about Europe's debt crisis. The higher rates suggest that investors are still skeptical that the country will get its budget under control despite a new government coming to power this week.

Investors have been worried that Spain could become the next country to need financial support from its European neighbors if its borrowing rates climb to unsustainable levels.

Greece was forced to seek relief from its lenders after its long-term borrowing rates rose above 7 percent. The rate on Spain's own benchmark 10-year bond is dangerously close to that level, 6.58 percent.

Underscoring jitters was the lack of market reaction to an announcement by the International Monetary Fund that it will provide quick cash on flexible terms to countries facing sudden financial stress.

"Failure of this news to result in significant gains across markets shows just how cautious investors are," Stan Shamu of IG Markets in Melbourne said in a report.

Concerns remain that Europe's debt crisis is pushing the region toward recession, which would slow industrial activity in countries around the world that export to Europe.

Australian resource shares took a big hit after the country's House of Representatives approved a law imposing a windfall profits tax on big mining companies. The Senate is expected to endorse the measure in early 2012.

BHP Billiton, the world's largest mining company, fell 3.1 percent. Rival Rio Tinto lost 3.4 percent and Energy Resources of Australia plummeted 5.9 percent.

In Seoul, auto parts maker Mando rose 2.6 percent on hopes that a free trade pact between South Korea and Washington would boost its earnings, Yonhap News Agency reported.

On Tuesday, the Dow Jones industrial average lost 0.5 percent to close at 11,493.72. The Standard & Poor's 500 fell 0.4 percent to 1,188.04. The Nasdaq composite fell 0.1 percent to 2,521.28.

Benchmark oil for January delivery was down $1.04 to $96.97 a barrel in electronic trading on the New York Mercantile Exchange. The contract rose $1.09 to finish at $98.01 per barrel on the Nymex on Tuesday.

In currencies, the euro fell to $1.3457 from $1.3509 late Tuesday in New York. The dollar was little changed at 76.98 yen.

Sunday, November 20, 2011

Richard Rhodes' Trading Rules

Richard Rhodes passes along these “ridiculously simple” trading rules, given to him by “a great trader some 15 years ago.”

Follow these rules, breaking them infrequently, and you will make money year in and year out.

The rules are simple. Sticking to them is what’s difficult.

Follow these rules, breaking them infrequently, and you will make money year in and year out.

The rules are simple. Sticking to them is what’s difficult.

“Old Rules…but Very Good Rules”

- The first and most important rule is – in bull markets, one is supposed to be long. This may sound obvious, but how many of us have sold the first rally in every bull market, saying that the market has moved too far, too fast. I have before, and I suspect I’ll do it again at some point in the future. Thus, we’ve not enjoyed the profits that should have accrued to us for our initial bullish outlook, but have actually lost money while being short. In a bull market, one can only be long or on the sidelines. Remember, not having a position is a position.

- Buy that which is showing strength –sell that which is showing weakness. The public continues to buy when prices have fallen. The professional buys because prices have rallied. This difference may not sound logical, but buying strength works. The rule of survival is not to “buy low, sell high”, but to “buy higher and sell higher”. Furthermore, when comparing various stocks within a group, buy only the strongest and sell the weakest.

- When putting on a trade, enter it as if it has the potential to be the biggest trade of the year. Don’t enter a trade until it has been well thought out, a campaign has been devised for adding to the trade, and contingency plans set for exiting the trade.

- On minor corrections against the major trend, add to trades. In bull markets, add to the trade on minor corrections back into support levels. In bear markets, add on corrections into resistance. Use the 33-50% corrections level of the previous movement or the proper moving average as a first point in which to add.

- Be patient. If a trade is missed, wait for a correction to occur before putting the trade on.

- Be patient. Once a trade is put on, allow it time to develop and give it time to create the profits you expected.

- Be patient. The old adage that “you never go broke taking a profit” is maybe the most worthless piece of advice ever given. Taking small profits is the surest way to ultimate loss I can think of, for small profits are never allowed to develop into enormous profits. The real money in trading is made from the one, two or three large trades that develop each year. You must develop the ability to patiently stay with winning trades to allow them to develop into that sort of trade.

- Be patient. Once a trade is put on, give it time to work; give it time to insulate itself from random noise; give it time for others to see the merit of what you saw earlier than they.

- Be impatient. As always, small loses and quick losses are the best losses. It is not the loss of money that is important. Rather, it is the mental capital that is used up when you sit with a losing trade that is important.

- Never, ever under any condition, add to a losing trade, or “average” into a position. If you are buying, then each new buy price must be higher than the previous buy price. If you are selling, then each new selling price must be lower. This rule is to be adhered to without question.

- Do more of what is working for you, and less of what’s not. Each day, look at the various positions you are holding, and try to add to the trade that has the most profit while subtracting from that trade that is either unprofitable or is showing the smallest profit. This is the basis of the old adage, “let your profits run.”

- Don’t trade until the technicals and the fundamentals both agree. This rule makes pure technicians cringe. I don’t care! I will not trade until I am sure that the simple technical rules I follow, and my fundamental analysis, are running in tandem. Then I can act with authority, and with certainty, and patiently sit tight.

- When sharp losses in equity are experienced, take time off. Close all trades and stop trading for several days. The mind can play games with itself following sharp, quick losses. The urge “to get the money back” is extreme, and should not be given in to.

- When trading well, trade somewhat larger. We all experience those incredible periods of time when all of our trades are profitable. When that happens, trade aggressively and trade larger. We must make our proverbial “hay” when the sun does shine.

- When adding to a trade, add only 1/4 to 1/2 as much as currently held. That is, if you are holding 400 shares of a stock, at the next point at which to add, add no more than 100 or 200 shares. That moves the average price of your holdings less than half of the distance moved, thus allowing you to sit through 50% corrections without touching your average price.

- Think like a guerrilla warrior. We wish to fight on the side of the market that is winning, not wasting our time and capital on futile efforts to gain fame by buying the lows or selling the highs of some market movement. Our duty is to earn profits by fighting alongside the winning forces. If neither side is winning, then we don’t need to fight at all.

- Markets form their tops in violence; markets form their lows in quiet conditions.

- The final 10% of the time of a bull run will usually encompass 50% or more of the price movement. Thus, the first 50% of the price movement will take 90% of the time and will require the most backing and filling and will be far more difficult to trade than the last 50%.

Tuesday, November 15, 2011

The market is going down as shown from this 5-min. chart from the Globex market.

It's a continuation from yesterday's downturn.

The market is being affected by the sad developments that is coming from Europe.

Unless investors/traders make up their decision making and continue to rely on these news, the market will be in the range mode for quite a while.

It's a continuation from yesterday's downturn.

The market is being affected by the sad developments that is coming from Europe.

Unless investors/traders make up their decision making and continue to rely on these news, the market will be in the range mode for quite a while.

Friday, November 11, 2011

In Search of a Winning Strategy

As traders we must attempt to identify profitable trading strategies; a creative process. Sifting through a wealth of information, mentally testing and retesting our strategy; attempting to decide if it will work under the current market environment, or which market environments are ideal for the strategy.

In your search there comes a point when you start to believe that you’re right. At this point in time, you must stop deliberating whether or not to go with a particular strategy, and make a final decision.

If you’re like many traders, however, you’ve made your share of bad decisions. Psychologists have studied the thought processes that go into making decisions. It’s a two-stage process, according to Dr. Daniel Gilbert, a professor of psychology at Harvard University. When you are evaluating a strategy, there comes a point in time, when you start to believe that it is true. That is the first stage of the decision making process, believing that you are right. The second stage consists of determining whether or not you are actually right.

The human mind seems to work in a peculiar way. In order to fully understand and mull over a strategy, we must first believe it is true, even if it is actually false. After we accept the strategy as true, we then go through a process of thinking and re-thinking the strategy before finally deciding if our initial acceptance of the strategy is prudent.

Let’s look at an example. Suppose you decided from what you have read and heard that a company that is about to announce earnings, was going to surprise on the upside. That is your hypothesis, your strategy. You first accept that you are right, that is stage 1 of the thinking process. After all if you thought your strategy was wrong you would just forget it and move on.

What if you decided the strategy was right, but then stopped deliberating, instead of continuing to question whether or not you made a good decision? If you avoid Stage 2 of the thinking process, you’ll continually jump to the wrong conclusion. You must think and rethink the strategy a little while longer; play Devil’s Advocate, think about what might go wrong. What is the risk if I am wrong, can I reasonably protect myself in that event?

Research studies have shown that when people are under time pressure, or tired and worn out, they do not fully deliberate their decisions. In other words, they engage in Stage 1 thinking, they accept that their hypothesis is true, but they avoid Stage 2 thinking; they assume their initial hunch is right without fully considering evidence that may refute its authenticity.

When making a trading decision, you must fully deliberate your alternatives. It’s perhaps a fine line between deliberating too much and being impulsive. Don’t rush the decision making process. Slow down, and realize your limitations.

Subscribe to:

Comments (Atom)