To all traders: losers; winners; beginners; old timers...

May you have a very Merry Christmas this two thousand twelve...

If you are a winning trader, good for you and keep what you are doing...

And if you are a losing trader, stop, look and listen...

Consult your inner mind if trading is the right vocation...

Merry Christmas too for the newer traders...

For they make the seasoned traders happy as ever...

For they don't know what they are doing...

They trade based from their own liking...

Thought that trading is the quickest way in money making...

Merry Christmas too for the traders educators (sic)...

For they don't make money in trading...

They turn to educating to make money as racketing...

Signing up to their alerts or recommending...

Keeps your mind boggling...

Merry Christmas too to the traders who are struggling...

For they chased their trades to keep up with pricing...

It turns out that the other side is already profiting...

Then they change their technique from day trading to milliseconds trading...

Until they found out they have no more trading (runs out of capital)...

Merry Christmas too for all seasoned traders...

May you have more "seasoned" years in market making...

For without your wits and exploiting...

The market will be dying...

And there will be no more trading...

Finally, Merry Christmas to all market participants...

Traders, investors, schemers, policymakers, ponziers, retirees, whatevers...

Your presence is highly appreciating...

For without your presence, the market is boring as ever...

A very Merry Christmas to all...

May you continue patronizing the greatest money game of all time...

'Trading is a process of observing the market's action until such a time you can find and form trading ideas and get involved.'**

Monday, December 24, 2012

Saturday, December 22, 2012

Cash Is King: Printing of $100 Bills Soars

A good detective always looks for a motive when beginning an

investigation. And so, when Nick Colas discovered that the number of $100

bills printed last year suddenly spiked, the chief market strategist at

ConvergEx Group decided to figure out what was going on.

The first thing he discovered, as we discuss in the attached video, is that "$100 bills are still wildly popular and growing in popularity." On the other hand, the use of smaller denomination bills ($1, $5, $10 and $20) has been declining for over a decade, as the number of cashless transactions has steadily gone up. In fact, in the fiscal year that just ended in October, Colas writes in a recent note to clients, the U.S. Bureau of Engraving and Printing cranked out 3 billion, $100 notes.

"That's substantially higher than the run-rate of the past couple of years," Colas points out, and 50% more than the 2 billion $1 bills that were inked up. "It's actually a record amount of production," he says.

All of which begs the question, why?

Part of this new demand, he says, comes from the classic nefarious sources: drug dealers, arms smugglers, tax cheats and bribes. But some of it is also due to hoarding or the fact that more people than ever, oddly enough, are losing faith in government and/or the economy and are shunning the surety of traditional investments. It's a phenomenon that's led to a huge increase in demand for gold and other precious metals, but also for — you guessed it — $100 bills.

And it's not just here at home. While it's hard to quantify the exact amount, it is believed that the majority of $100 bills are probably being held overseas, since they are globally recognized, widely accepted and the easiest way to store wealth.

"Cash really is king if you want to preserve wealth in an increasing tax environment," Colas says, noting that while gold is a viable strategy for saving some money, "nothing beats a $100 bill if you have to buy some food."

What's interesting, or inexplicable, to many money watchers is that this huge increase in the printing of old-style $100 bills happened right before the expected launch of the new and improved $100 bills that will include a 3-D blue stripe and bell-in-an-inkwell security features. According to the Federal Reserve and its NewMoney.gov website, production problems have delayed the launch of the newest $100 notes for over a year now, though an announcement is expected soon.

In the meantime, with bank deposit rates and yields on U.S. Treasury bills at record lows and paying next to nothing, savers miss out on very little interest if they choose to hold cash rather than invest it.

But alas, there is a silver lining to be found within all of this dollar debasement that at least one Wall Street veteran points to. "It proves beyond a doubt that the dollar is still the reserve currency of choice around the world," Colas concludes. "It may not [always] be from the most savory part of the economy, but it does signal that there's still a lot of faith in the dollar."

Tuesday, December 18, 2012

Market Rally

The market did rally today not only due to fiscal cliff seemingly positive resolution but also from the participants bullish conviction.

The Santa rally is still in effect despite some economic/market hurdles.

Let's see with the remaining trading days if it will continue.

The Santa rally is still in effect despite some economic/market hurdles.

Let's see with the remaining trading days if it will continue.

Market Rally Is Now For Real?

I guess that's what these chart sentiments is showing.

It's only natural for the market to stall it's traction, but the conviction for Santa rally is still there.

It's only natural for the market to stall it's traction, but the conviction for Santa rally is still there.

Sunday, December 16, 2012

Trading Come 2013

Two weeks left trading the market this year of 2012 and we have to start planning come 2013.

If we did not do pretty well this year, we have to regroup and learn from it.

Let's move ahead and forget the mistakes.

The important thing is we have to learn from them and not (try) to repeat them again.

We need to be more passionate with our trading endeavor - as ever.

We have to look forward since trading (the market) is a forward moving train.

Sometimes we have to stop and examine what's ahead so that we can plan our moves.

This coming 2013 it seems more hurdles in the market.

Let's just explore whatever opportunities the market offers.

Let's stay cool, calm, balance, and not be driven by the impulsive euphoria.

In that way we can trade better with concrete evidence and not succumb to temptation.

I learned that trading is not to trade often, be selective with the trade locations, and need not listen to anyone except to our own self.

Looking forward for a better trading come 2013.

If we did not do pretty well this year, we have to regroup and learn from it.

Let's move ahead and forget the mistakes.

The important thing is we have to learn from them and not (try) to repeat them again.

We need to be more passionate with our trading endeavor - as ever.

We have to look forward since trading (the market) is a forward moving train.

Sometimes we have to stop and examine what's ahead so that we can plan our moves.

This coming 2013 it seems more hurdles in the market.

Let's just explore whatever opportunities the market offers.

Let's stay cool, calm, balance, and not be driven by the impulsive euphoria.

In that way we can trade better with concrete evidence and not succumb to temptation.

I learned that trading is not to trade often, be selective with the trade locations, and need not listen to anyone except to our own self.

Looking forward for a better trading come 2013.

Saturday, December 15, 2012

A Derailed Santa Rally

The rally that i had been watching in the market the past week is having a hard time getting its traction.

I guess the Santa rally everybody is expecting has been derailed due to the fiscal cliff problem.

Only two weeks left trading the market before 2013, and it seems the market will just consolidate.

Though there might be some spike(s), but profiteers will just annihilate whatever market spikes will erupt before the year ends.

It is still a traders market, better for the investors to take the holiday break now.

I guess the Santa rally everybody is expecting has been derailed due to the fiscal cliff problem.

Only two weeks left trading the market before 2013, and it seems the market will just consolidate.

Though there might be some spike(s), but profiteers will just annihilate whatever market spikes will erupt before the year ends.

It is still a traders market, better for the investors to take the holiday break now.

Tuesday, December 11, 2012

Market Will Santa Rally?

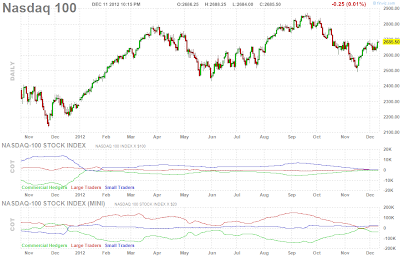

The way it looks with this daily chart from the Nasdaq futures, there is a 'spring coil' the market rally.

It is forming an inverted head and shoulder pattern, or a cup with a handle.

A pattern that a bullish scenario is unfolding the last few weeks of market trading this year of 2012.

The way i look at it, the target till the year ends is at around 2800.00 plus.

A buy signal is now appropriate with stop at 2600.00.

Let see come the days ahead if it will sustain.

It is forming an inverted head and shoulder pattern, or a cup with a handle.

A pattern that a bullish scenario is unfolding the last few weeks of market trading this year of 2012.

The way i look at it, the target till the year ends is at around 2800.00 plus.

A buy signal is now appropriate with stop at 2600.00.

Let see come the days ahead if it will sustain.

Monday, December 3, 2012

It's Santa Rally...Really?

Showing this daily chart from the Nasdaq QQQ already rallying up after some profit taking (correction).

As i mentioned from my previous post, a Santa rally might be on the way and i think this chart is proving that.

It formed a "v" formation since it bottom(ed) in mid November session.

The way i look at it, seems it is forming an inverted head and shoulder pattern here.

A sign that the bullish sentiment from the participants is highly probable.

It might struggle a bit (maybe?) in a few days, possibly a week or so but this i think the rally is on the way.

Lucky for those who where able to buy at the bottom.

In the meantime, for us traders, let's take the market on a daily basis and explore the opportunities.

As i mentioned from my previous post, a Santa rally might be on the way and i think this chart is proving that.

It formed a "v" formation since it bottom(ed) in mid November session.

The way i look at it, seems it is forming an inverted head and shoulder pattern here.

A sign that the bullish sentiment from the participants is highly probable.

It might struggle a bit (maybe?) in a few days, possibly a week or so but this i think the rally is on the way.

Lucky for those who where able to buy at the bottom.

In the meantime, for us traders, let's take the market on a daily basis and explore the opportunities.

Friday, November 23, 2012

Friday's Market

The market opened today on a high note.

It gap up in the open after the holiday break.

All the market did was to buy...buy...buy...and the sellers (shorters) were absent (where are they?).

It will be a short trading day today for the market will be closed at 1:00 pm. ET.

Let's see come Monday's market if the positive sentiment will continue.

Today's market is the best day for would be traders or for those struggling/losing traders (like this one).

Not much noise/volatility for the notorious HFT's are still drowning from the devil spirit of alcohol (err... wine?) because of the holiday? Sorry...just trying to sensationalized this post a little bit to make some attention from my readers... if there are!

But who am i to categorized that this kind of market is best to trade while the majority of the participants are out.

Through market presence regularly i can say that was the market behavior since started watching the market from years back.

It's like taking advantage from the drunkards while they are drowning and steal? profit from their absence.

The market is an exercise of human behavior and if you can read their minds (the minds of the markets), you can make the difference and take opportunities that the market offers.

It gap up in the open after the holiday break.

All the market did was to buy...buy...buy...and the sellers (shorters) were absent (where are they?).

It will be a short trading day today for the market will be closed at 1:00 pm. ET.

Let's see come Monday's market if the positive sentiment will continue.

Today's market is the best day for would be traders or for those struggling/losing traders (like this one).

Not much noise/volatility for the notorious HFT's are still drowning from the devil spirit of alcohol (err... wine?) because of the holiday? Sorry...just trying to sensationalized this post a little bit to make some attention from my readers... if there are!

But who am i to categorized that this kind of market is best to trade while the majority of the participants are out.

Through market presence regularly i can say that was the market behavior since started watching the market from years back.

It's like taking advantage from the drunkards while they are drowning and steal? profit from their absence.

The market is an exercise of human behavior and if you can read their minds (the minds of the markets), you can make the difference and take opportunities that the market offers.

Thursday, November 22, 2012

Wednesday's Market

The market barely made a move last Wednesday's trading.

Partly because of the Thanksgiving day.

Participants are already preparing for the turkey feast.

Not much volume was recorded but the sentiments is still bullish as can be seen from the charts below.

Let's see come next week regular trading if it will continue.

But i guess there is some sluggish trend in the coming days or weeks probably.

Meanwhile, let's have some market break!

Partly because of the Thanksgiving day.

Participants are already preparing for the turkey feast.

Not much volume was recorded but the sentiments is still bullish as can be seen from the charts below.

Let's see come next week regular trading if it will continue.

But i guess there is some sluggish trend in the coming days or weeks probably.

Meanwhile, let's have some market break!

Monday, November 19, 2012

The Market Really Bounced!

As i mentioned from my previous post, the market is ready to bounce and it did today.

If that is for real, i don't know, let's see in the coming trading days.

But as now the way the market is acting, looks like it's the start of the Santa rally.

If that is for real, i don't know, let's see in the coming trading days.

But as now the way the market is acting, looks like it's the start of the Santa rally.

Sunday, November 18, 2012

Start of the bounce?

The way market action last Friday seems the start of the bounce?

I guess so, by looking at the chart you can notice that the participants jumped in aggressively and bought the market between 11:00 am. and 12:00 noon ET.

I presume it might continue to struggle for a while but the Santa rally is in the offing.

It will consolidate within a week or so and might rally from thereon.

Let's see come Monday's trading if the sentiments look positive.

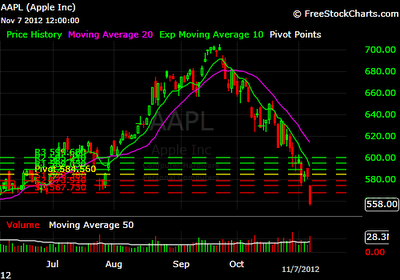

And Apple (APPL) stock is now being sold daily by the profiteers.

A sign that the $1,000.00 per share valuation is now impossible to reach?

The way it looks from this daily chart, it reached already the maximum price.

Time to get out while there still some profit?

And facebook (FB) is now a buy?

Seems so as this daily chart is showing.

I guess so, by looking at the chart you can notice that the participants jumped in aggressively and bought the market between 11:00 am. and 12:00 noon ET.

I presume it might continue to struggle for a while but the Santa rally is in the offing.

It will consolidate within a week or so and might rally from thereon.

Let's see come Monday's trading if the sentiments look positive.

A sign that the $1,000.00 per share valuation is now impossible to reach?

The way it looks from this daily chart, it reached already the maximum price.

Time to get out while there still some profit?

Seems so as this daily chart is showing.

Thursday, November 15, 2012

What's Happening With The Market?

Is the market plunging?

That's what these charts says so!

Unless Santa will rescue the market and pour/print some money to buy the market, there will be no sign of relief.

Bears are on a roll and the bulls are covering in darkness.

Time for the 'dip' investors to look for bargains, if they still have some 'parked' money.

Let's see in the days or weeks ahead if the market will run out (of sells) and time for the buyers to step in.

But i guess this market correction will stay for a while possibly weeks/months before it can get back its traction.

Let's just all be patient.

That's what these charts says so!

Unless Santa will rescue the market and pour/print some money to buy the market, there will be no sign of relief.

Bears are on a roll and the bulls are covering in darkness.

Time for the 'dip' investors to look for bargains, if they still have some 'parked' money.

Let's see in the days or weeks ahead if the market will run out (of sells) and time for the buyers to step in.

But i guess this market correction will stay for a while possibly weeks/months before it can get back its traction.

Let's just all be patient.

Tuesday, November 13, 2012

Just to have something to post?

Not doing any trading for the market is not giving some opportunities or ideas how to participate.

The market is acting inappropriate (these days?) and its hard to make a conclusive evidence to make a sound judgment how we can react or take action with its bipolar? (as Warren Buffet sometimes referred to?) behavior.

When the market (re)acts that way, so does most of the participants?

I don't know, but when the market is acting like this, the best way for the trader is to stay idle and let the market do what it wants to do.

Have patience and wait until the market settles or when the market becomes rationale.

For today's market, it's still suffering a disorder and (was) not yet diagnosed when or what kind of cure/pill to be given to.

I guess the market needs a tranquilizer to take a breather or the form of recreational medicine (like that one that was ratified/legalized by some states?).

As can be seen from this 5-min. chart (unless you are an HFT's), if you are trading alone as a discretionary, you cannot trade this in comfort? or it will be hard to participate.

I don't know but this is how i can characterized this market as of the moment.

This is also a lesson to learn for the future, since the market as we all know is always acting in an irrational manner.

No doubt about that, we cannot expect the market to act efficiently.

That's why we as traders needs to learn from it and work on our self too.

The market is acting inappropriate (these days?) and its hard to make a conclusive evidence to make a sound judgment how we can react or take action with its bipolar? (as Warren Buffet sometimes referred to?) behavior.

When the market (re)acts that way, so does most of the participants?

I don't know, but when the market is acting like this, the best way for the trader is to stay idle and let the market do what it wants to do.

Have patience and wait until the market settles or when the market becomes rationale.

For today's market, it's still suffering a disorder and (was) not yet diagnosed when or what kind of cure/pill to be given to.

I guess the market needs a tranquilizer to take a breather or the form of recreational medicine (like that one that was ratified/legalized by some states?).

As can be seen from this 5-min. chart (unless you are an HFT's), if you are trading alone as a discretionary, you cannot trade this in comfort? or it will be hard to participate.

I don't know but this is how i can characterized this market as of the moment.

This is also a lesson to learn for the future, since the market as we all know is always acting in an irrational manner.

No doubt about that, we cannot expect the market to act efficiently.

That's why we as traders needs to learn from it and work on our self too.

Monday, November 12, 2012

Monday's Trade Setup

The market was on a slow movement today partly because of the holiday (Veteran's Day), most participants are on vacation.

For the trade today, the market seems it will continue its downside momentum when it opened high only to lose its fire and made a flat consolidation below the settlement price.

Opening for an opportunity to buy within the ma's crossover.

The exit is pointed above (with an arrow).

Patience needs to exercise with this kind of trade.

For the trade today, the market seems it will continue its downside momentum when it opened high only to lose its fire and made a flat consolidation below the settlement price.

Opening for an opportunity to buy within the ma's crossover.

The exit is pointed above (with an arrow).

Patience needs to exercise with this kind of trade.

Saturday, November 10, 2012

Friday's Market Action

The market barely risen from its hole last Friday's action.

But at least it had shown a sign of relief that it can bounce back from the grave.

For Friday's trade, a buy in the open and sell below R1 (resistance) is the most appropriate spot to make a profit as shown from this 5-min. chart.

Steve Job's Apple (AAPL) also risen from the dead when it bounced back last Friday's session.

And Facebook (FB) stock needs to face reality that it has a hard time convincing investors to move the stock from its previous IPO price of $40.00 down to its present price of $19.18. I guess its needs fresh ideas to convince this social networking users in a more productive and appropriate manner rather than using it for 'fun'?

But at least it had shown a sign of relief that it can bounce back from the grave.

For Friday's trade, a buy in the open and sell below R1 (resistance) is the most appropriate spot to make a profit as shown from this 5-min. chart.

Steve Job's Apple (AAPL) also risen from the dead when it bounced back last Friday's session.

And Facebook (FB) stock needs to face reality that it has a hard time convincing investors to move the stock from its previous IPO price of $40.00 down to its present price of $19.18. I guess its needs fresh ideas to convince this social networking users in a more productive and appropriate manner rather than using it for 'fun'?

Thursday, November 8, 2012

Thursday's Trade Setup

The market continues to slide down.

The sellers outnumber the buyers and the market is not showing any sign of relief.

For today's market trade, a sell (short) in the open and cover at the close is the best way to make money.

An easy day today to make money trading the market.

The sellers outnumber the buyers and the market is not showing any sign of relief.

For today's market trade, a sell (short) in the open and cover at the close is the best way to make money.

An easy day today to make money trading the market.

Wednesday, November 7, 2012

The Markets After Effect Election

The market reacted sharply from the recent electoral conclusion.

Seems the market did not agree with the election result and the sell off triggered.

All the market indices were all on the selling spree as soon as the market opens and continues till the closed.

I will not be surprised if the market will all break lose come tomorrow's market.

The following charts shows how the market reacted with the recent election.

And the Apple (AAPL) stock is losing its eye from the investor.

Is this the end of cliff for Apple?

Your guess is as good as mine!

Seems the market did not agree with the election result and the sell off triggered.

All the market indices were all on the selling spree as soon as the market opens and continues till the closed.

I will not be surprised if the market will all break lose come tomorrow's market.

The following charts shows how the market reacted with the recent election.

Is this the end of cliff for Apple?

Your guess is as good as mine!

Tuesday, November 6, 2012

Presidential Election Trade Setup

The market was on the uncertain moves early in the open probably because of the presidential election.

I guess the market participants are gauging the trend of the voters who is going to get the majority votes because of the closed contest.

And this chart shows that by the time (around 11:30 am. E.T.) the market rallied, seems the participants had the idea who's going to win.

Let's just wait and see by night time!

For the trade today, I call it the Presidential Election Trade Setup.

Buying at the settlement price when the MA's shows confirmation (arrow) for a long trade.

Exit the trade within the R2 level is the best trade for today considering the market is looking for a certain direction.

No need to wait for the whole market session for it might turn volatile at the latter part because of the election.

Trade safely!

I guess the market participants are gauging the trend of the voters who is going to get the majority votes because of the closed contest.

And this chart shows that by the time (around 11:30 am. E.T.) the market rallied, seems the participants had the idea who's going to win.

Let's just wait and see by night time!

For the trade today, I call it the Presidential Election Trade Setup.

Buying at the settlement price when the MA's shows confirmation (arrow) for a long trade.

Exit the trade within the R2 level is the best trade for today considering the market is looking for a certain direction.

No need to wait for the whole market session for it might turn volatile at the latter part because of the election.

Trade safely!

Sunday, November 4, 2012

The most indebted man in the world owes former employer $6.3 billion

Former financial arbitrage trader Jerome Kerviel is the most indebted man on the planet, owing his former employer $6.3 billion.

The amount Kerviel owes to French bank Societe Generale for fraudulent trades made in 2007 and 2008 would make Kerviel one of the 50 richest people in America if those debts were assets.

But Kerviel cannot even begin paying off his debts until 2015, when he is scheduled to be released from prison. Kerviel recently lost an appeal case in which he argued the corruption at Societe Generale was widespread.

The Atlantic's Matthew O'Brien writes that Kerviel managed €50 billion ($73 billion in unadjusted dollars) worth of unauthorized trades during his tenure at Societe Generale, using a sophisticated scheme of computer hacking and deceptive trades to deceive the bank.

O'Brien writes:

"In plain English, arbitrage just means taking advantage of discrepancies when things should have the same price, but don't. The idea is to buy the cheaper one, sell the more expensive one, and then wait for them to converge. The beauty is it doesn't matter whether markets go up or down--you're both long and short--just that the prices actually converge."

O'Brien spoke with former investment banker and current University of San Diego law professor Frank Partnoy about the logistics of trying to collect $6.3 billion from a single individual.

"Well, he's obviously not going to be able to pay the fine," Partnoy told the Atlantic. "What happened to Kerviel is the financial equivalent of sentencing someone to life plus 100 years. They'll likely reach some kind of agreement where a significant percentage of any money he makes for the rest of his life will be paid into a fund to cover the fine. He'll be like Sisyphus pushing the boulder up the hill every day for the rest of his life."

And while you could debate whether there are better ways for Kerviel to pay back Societe Generale, Partnoy offers a stark comparison to the fines levied against some of the world's largest financial institutions. In 2010, Goldman Sachs agreed to a $550 million settlement with Securities Exchange Commission, paid in part to investors and the U.S. government, which the SEC described as the largest settlement in history against any Wall Street firm.

Facebook's Sandberg sells $7.4 million in stock

Reuters – Fri, Nov 2, 2012 7:43 PM EDT

SAN FRANCISCO (Reuters) - Facebook Inc Chief Operating Officer Sheryl Sandberg and two other executives at the social networking company sold millions of dollars worth of stock this week as restrictions on insider trading expired.

Sandberg netted about $7.44 million by selling roughly 353,000 Facebook shares on Wednesday, according to a filing with the SEC on Friday. Sandberg still owns roughly 20 million vested shares of Facebook stock, including shares held in her trusts, according to the filing.

Facebook General Counsel Theodore Ullyot and Chief Accounting Officer David Spillane also sold millions of dollars worth of shares this week, according to filings. All the Facebook executives' sales were part of pre-arranged stock trading plans.

The sales are the first by Facebook's senior management following the company's high-profile initial public offering in May.

The world's No.1 online social network became the only U.S. company to debut with a market value of more than $100 billion, but has seen its value plunge more than 40 percent since then on concerns about its long-term money-making prospects.

Shares of Facebook, which were priced at $38 in the IPO, closed Friday's regular session down 3 cents at $21.18.

The flood of shares set to hit the market as insider trading "lock-up" provisions expire in several phases have added to the pressure on Facebook's stock.

Roughly 230 million shares of Facebook became eligible for trading this week, as trading restrictions for employees expired. Another 800 million shares will be eligible for trading on November 14, significantly expanding the "float" of roughly 692 million Facebook shares that were available for trading as of September 30.

Facebook's 28-year-old chief executive, Mark Zuckerberg, has committed to not sell any shares before September 2013.

Ullyot sold slightly more than 149,000 shares on Wednesday and Thursday, collecting $3.13 million. Ullyot has an additional 1.27 million in vested shares.

Spillane sold 256,000 shares on Wednesday, more than half of his vested shares, for proceeds of $5.4 million. Spillane had more than 863,000 Facebook shares, including unvested shares, according to a filing in May.

(Reporting By Alexei Oreskovic; Editing by Bernard Orr)

By Alexei Oreskovic

Sandberg netted about $7.44 million by selling roughly 353,000 Facebook shares on Wednesday, according to a filing with the SEC on Friday. Sandberg still owns roughly 20 million vested shares of Facebook stock, including shares held in her trusts, according to the filing.

Facebook General Counsel Theodore Ullyot and Chief Accounting Officer David Spillane also sold millions of dollars worth of shares this week, according to filings. All the Facebook executives' sales were part of pre-arranged stock trading plans.

The sales are the first by Facebook's senior management following the company's high-profile initial public offering in May.

The world's No.1 online social network became the only U.S. company to debut with a market value of more than $100 billion, but has seen its value plunge more than 40 percent since then on concerns about its long-term money-making prospects.

Shares of Facebook, which were priced at $38 in the IPO, closed Friday's regular session down 3 cents at $21.18.

The flood of shares set to hit the market as insider trading "lock-up" provisions expire in several phases have added to the pressure on Facebook's stock.

Roughly 230 million shares of Facebook became eligible for trading this week, as trading restrictions for employees expired. Another 800 million shares will be eligible for trading on November 14, significantly expanding the "float" of roughly 692 million Facebook shares that were available for trading as of September 30.

Facebook's 28-year-old chief executive, Mark Zuckerberg, has committed to not sell any shares before September 2013.

Ullyot sold slightly more than 149,000 shares on Wednesday and Thursday, collecting $3.13 million. Ullyot has an additional 1.27 million in vested shares.

Spillane sold 256,000 shares on Wednesday, more than half of his vested shares, for proceeds of $5.4 million. Spillane had more than 863,000 Facebook shares, including unvested shares, according to a filing in May.

(Reporting By Alexei Oreskovic; Editing by Bernard Orr)

Visa Is The Passport To Good Investing

Showing the weekly and monthly chart of the Visa (V) stock since its IPO in the mid of 2009.

It formed a cup with a handle between 2009 and 2010 (the monthly chart).

Since then it continues to go higher.

This is the classic form of good investing, the buy and hold as Warren Buffet, Peter Lynch profess?

'A buy what you know investing', considering Visa is a household name before it bacame a public company.

If you buy 100 shares then say $60.00 per share ($6,000.00) , your investment now at $143.00 is netting +$8,300.00 ($14,300.00).

That's more than 50% gain, and the stock will continue to go higher the way it is performing.

It formed a cup with a handle between 2009 and 2010 (the monthly chart).

Since then it continues to go higher.

This is the classic form of good investing, the buy and hold as Warren Buffet, Peter Lynch profess?

'A buy what you know investing', considering Visa is a household name before it bacame a public company.

If you buy 100 shares then say $60.00 per share ($6,000.00) , your investment now at $143.00 is netting +$8,300.00 ($14,300.00).

That's more than 50% gain, and the stock will continue to go higher the way it is performing.

Saturday, November 3, 2012

Friday's Trade Setup

After Thursday's jumper trade, the market somersaulted last Friday's trading day.

After the euphoria, the market turn ugly and made a turnaround.

Probably because of Friday, a profit taking days for the traders.

Likewise of the Apple stock (AAPL), it went on a selling spree the past days and that affected the whole market.

It's like where the Apple goes, so the market too.

For last Friday's trade setup, the best entry is to short the market where it starts the signal below the settlement price as shown from the arrow below.

The moving averages gave the confirmation when its starts to crosses over and descends below the previous close.

Exit the trade before the market close.

After the euphoria, the market turn ugly and made a turnaround.

Probably because of Friday, a profit taking days for the traders.

Likewise of the Apple stock (AAPL), it went on a selling spree the past days and that affected the whole market.

It's like where the Apple goes, so the market too.

For last Friday's trade setup, the best entry is to short the market where it starts the signal below the settlement price as shown from the arrow below.

The moving averages gave the confirmation when its starts to crosses over and descends below the previous close.

Exit the trade before the market close.

Friday, November 2, 2012

Thursday's Jumper Trade

The market 'jumped' early in the market open last Thursday's market.

It continues to move upwards till the close.

I guess all the participants were eager to buy the market because of 'after effect' from Sandy (hurricane) that batters the east coast especially in New York where the market seats.

The best entry is to buy the market in the open and exit before the close for a no-brainer trade?

This trade setup is a predictable 'kinda' move considering the market was closed the past two days due to the storm and the market was initially opened last Wednesday.

Most participants were still out then (last Wednesday) that's why the market move erratically on that day.

Come Thursday, all participants were all pumped up to buy the market that's why it surge in the open.

The market is a study of human behavior, and it's important to monitor the market sentiments.

Read the minds of the market is all that matters!

It continues to move upwards till the close.

I guess all the participants were eager to buy the market because of 'after effect' from Sandy (hurricane) that batters the east coast especially in New York where the market seats.

The best entry is to buy the market in the open and exit before the close for a no-brainer trade?

This trade setup is a predictable 'kinda' move considering the market was closed the past two days due to the storm and the market was initially opened last Wednesday.

Most participants were still out then (last Wednesday) that's why the market move erratically on that day.

Come Thursday, all participants were all pumped up to buy the market that's why it surge in the open.

The market is a study of human behavior, and it's important to monitor the market sentiments.

Read the minds of the market is all that matters!

Friday, October 26, 2012

Friday's Trade Setup

The market was on the downtrend for the past four days of trading and doesn't show any sign of recovery.

There lots of events that was happening from around the globe that affected the whole market and likewise the earnings report of the most notable companies that moves the market, i.e., AAPL, GOOG, and others.

And most participants are taking early profits prior to the coming December holidays.

They are taking profits early to get the most advantage in price while the market is still way up.

At the same time they are taking position from other instruments, 'buying on the deep opportunities'.

For today's market, the Nasdaq index show some kind of late trading opportunity.

As can be seen from the chart below, the QQQ etf's, which is the equivalent 'kinda' of the NQ futures.

The best entry is when it made/show a reversal pattern above the S1 level.

It briefly consolidates/tested above that level and then vertically bounced up to the R1 level.

Nice catch if you were able to take this kind of opportunity/setup.

And the ascending MA's gave the confirmation for a long trade.

Have a nice weekend fellow traders, hope you were able to capitalize on this last trading setup opportunity, erasing all the losses (for the bulls) the past four trading days.

There lots of events that was happening from around the globe that affected the whole market and likewise the earnings report of the most notable companies that moves the market, i.e., AAPL, GOOG, and others.

And most participants are taking early profits prior to the coming December holidays.

They are taking profits early to get the most advantage in price while the market is still way up.

At the same time they are taking position from other instruments, 'buying on the deep opportunities'.

For today's market, the Nasdaq index show some kind of late trading opportunity.

As can be seen from the chart below, the QQQ etf's, which is the equivalent 'kinda' of the NQ futures.

The best entry is when it made/show a reversal pattern above the S1 level.

It briefly consolidates/tested above that level and then vertically bounced up to the R1 level.

Nice catch if you were able to take this kind of opportunity/setup.

And the ascending MA's gave the confirmation for a long trade.

Have a nice weekend fellow traders, hope you were able to capitalize on this last trading setup opportunity, erasing all the losses (for the bulls) the past four trading days.

Monday, October 22, 2012

Monday's Market Action

The market bounces back at the later part of trading.

It opened above from Friday's close only to make choppy/volatile moves almost the whole market hours.

The participants are gauging the market sentiments due to earnings reports and vital calendar market events.

Let's see come trading days ahead if the market will prevail from today's move.

It opened above from Friday's close only to make choppy/volatile moves almost the whole market hours.

The participants are gauging the market sentiments due to earnings reports and vital calendar market events.

Let's see come trading days ahead if the market will prevail from today's move.

Friday, October 19, 2012

Friday's Trade Setup

The market tumbled for the second day since yesterday, Thursday.

A follow through from yesterday's GOOG sell off.

A good trade today is to sell in the open and cover in the close as shown from this 5-min. chart.

Not much volatility, all sell off throughout the trading day.

A follow through from yesterday's GOOG sell off.

A good trade today is to sell in the open and cover in the close as shown from this 5-min. chart.

Not much volatility, all sell off throughout the trading day.

Tuesday, October 16, 2012

Tuesday's Trade Setup

The market gap up today for the continuing bullish trend from yesterday's market.

The best entry is to buy in the open and monitor its movement till the close.

Good trading environment in today's market.

The best entry is to buy in the open and monitor its movement till the close.

Good trading environment in today's market.

Monday, October 15, 2012

Monday's Trade Setup

The market is on the verge of downward movement the past weeks.

For today's market, it gap up in the open only to lose its momentum after an hour or so.

The best entry if within the settlement price as the two ma's crosses over.

It formed a "u" pattern and a cup with a handle bullish formation.

Spotting today's market involves recognition of pattern which plays a vital part in finding a probable trade.

The most probable exit on this setup is when the market closes its session.

For today's market, it gap up in the open only to lose its momentum after an hour or so.

The best entry if within the settlement price as the two ma's crosses over.

It formed a "u" pattern and a cup with a handle bullish formation.

Spotting today's market involves recognition of pattern which plays a vital part in finding a probable trade.

The most probable exit on this setup is when the market closes its session.

Friday, September 28, 2012

Friday's Trade Setup

Today's trade was not quite convincing but the price action and the double bottom pattern made it possible to place a trade.

The double bottom is recognizable within the support level (S1).

The entry is at the arrow below for a long trade when the ma's crosses over.

The exit is at above the pivot line when it starts to lose its steam.

Making a trade when the market is like this especially it's a Friday needs full concentration in watching the price movement.

Price action is all that matters and some kind of precise trading experience.

The double bottom is recognizable within the support level (S1).

The entry is at the arrow below for a long trade when the ma's crosses over.

The exit is at above the pivot line when it starts to lose its steam.

Making a trade when the market is like this especially it's a Friday needs full concentration in watching the price movement.

Price action is all that matters and some kind of precise trading experience.

Thursday, September 27, 2012

Best Trade Setup

The market made a nice move today and the best trade is to buy in the consolidation from the open.

Exit is at the arrow above.

Best trade setup!

Exit is at the arrow above.

Best trade setup!

Tuesday, September 25, 2012

Tuesday's Trade Setup

The market gap up today in the open only to lose its strength for the profiteers trying to make money early on.

The best entry is from the pullback below when the ma's cross over opening for a long trade.

The exit is at the arrow above just below the R2 level.

The best entry is from the pullback below when the ma's cross over opening for a long trade.

The exit is at the arrow above just below the R2 level.

Wednesday, September 19, 2012

Wednesday's Trade Setup

Not able to post some trade setups the past week for quite busy analyzing trades and other market indexes.

Though there are some breakouts the past weeks but if you are not in tune with the market timing, you will get chopped.

That's why in trading, it is important that timing plays a big part in capturing the main ingredient.

Otherwise, you will end up eating the dust and just trade for the sake of trading.

You will lose your mental capital that leads to impulsive trades.

For today's setup, the market open up high only to lose its strength after an hour or so.

It made a dramatic reversal from the support (S1) opening a long entry from the pivot line.

Exit the trade before the close for a nice trade.

Today's trade needs a lot of patience in monitoring the entry for it became choppier in-between R1 and R2 (the resistance levels).

Though there are some breakouts the past weeks but if you are not in tune with the market timing, you will get chopped.

That's why in trading, it is important that timing plays a big part in capturing the main ingredient.

Otherwise, you will end up eating the dust and just trade for the sake of trading.

You will lose your mental capital that leads to impulsive trades.

For today's setup, the market open up high only to lose its strength after an hour or so.

It made a dramatic reversal from the support (S1) opening a long entry from the pivot line.

Exit the trade before the close for a nice trade.

Today's trade needs a lot of patience in monitoring the entry for it became choppier in-between R1 and R2 (the resistance levels).

Tuesday, September 4, 2012

Tuesday's Trade Setup

The market drops hard today due to unfavorable manufacturing report.

After the sell off, the market made a turnaround and recovers.

The best entry is from above the support when it consolidates.

As of this posting, the market is still recovering.

Exit the trade at your target price.

After the sell off, the market made a turnaround and recovers.

The best entry is from above the support when it consolidates.

As of this posting, the market is still recovering.

Exit the trade at your target price.

Subscribe to:

Comments (Atom)