The market (YM) made a very nice excellent move today starting early in the Globex up to the last regular trading day.

Bulls are roaring in pandemonium while the bears are covering in darkness sniffing their own sweat.

Lots of shorters got trapped and they were force to cover their positions.

The market was controlled by the bulls the whole trading day.

No chance for the bears to take over.

Most went home sleep walking, unable to explain/figure out what happened with the market and why it skyrocketed.

Take a look at the chart and see for yourself why the bears are running away.

'Trading is a process of observing the market's action until such a time you can find and form trading ideas and get involved.'**

Wednesday, November 30, 2011

As I mentioned from my earlier post, unless there will be a positive news that might erupt from somewhere, the market will rise up.

And I was right with my perception, the market is just driven by the news.

It might be hard to put on a trade in the regular open today for the market already went up by almost 200 points in the Dow (YM).

Because the market always make its big move in the overnight session.

And I was right with my perception, the market is just driven by the news.

It might be hard to put on a trade in the regular open today for the market already went up by almost 200 points in the Dow (YM).

Because the market always make its big move in the overnight session.

The market is showing a negative weakness as shown from this chart in the Globex market.

It might just go sideways today in the regular open.

Unless there is a positive news that might erupt from somewhere, it might stay idle the whole trading day.

The market is just operating from rumors nowadays, that's why traders are to be reminded to "trade the rumors sell the news".

It might just go sideways today in the regular open.

Unless there is a positive news that might erupt from somewhere, it might stay idle the whole trading day.

The market is just operating from rumors nowadays, that's why traders are to be reminded to "trade the rumors sell the news".

Tuesday, November 29, 2011

A choppy market trading today.

Not much action today for the participants are watching each others back.

I can say the market is confused and looking for a direction.

I can't find a nice location for a swing setup today except to just wait for the next trading day.

That's how in trading, it's like fishing...waiting for the bait takes time and needs patience.

Not much action today for the participants are watching each others back.

I can say the market is confused and looking for a direction.

I can't find a nice location for a swing setup today except to just wait for the next trading day.

That's how in trading, it's like fishing...waiting for the bait takes time and needs patience.

The market (YM) is sustaining its momentum from yesterday's price action as shown from this 5-min. chart from the Globex.

I guess a volatile regular trading today.

It might be the right time to make a position/entry for a swing trade.

Let's see in the open if we can find the right location to put on a trade.

Yesterday's trade was not quite successful for the market already made its turn early in the open, so no more fire to ignite.

I guess a volatile regular trading today.

It might be the right time to make a position/entry for a swing trade.

Let's see in the open if we can find the right location to put on a trade.

Yesterday's trade was not quite successful for the market already made its turn early in the open, so no more fire to ignite.

Monday, November 28, 2011

Attention: Facebook Fanatics...

Facebook plans IPO between April and June: report

(Reuters) - Facebook Inc is looking to go public between April and June 2012 with a valuation of over $100 billion, the Wall Street Journal reported, citing people familiar with the matter.

The social media giant is considering raising as much as $10 billion in its IPO, the report said.

Sources familiar with the matter said the company has not made any decision over which banks will be involved in the IPO.

Facebook's CFO David Ebersman is in talks with Silicon Valley bankers about an IPO, but founder CEO Mark Zuckerberg has not decided on any terms of the IPO, the Journal said.

(Reuters) - Facebook Inc is looking to go public between April and June 2012 with a valuation of over $100 billion, the Wall Street Journal reported, citing people familiar with the matter.

The social media giant is considering raising as much as $10 billion in its IPO, the report said.

Sources familiar with the matter said the company has not made any decision over which banks will be involved in the IPO.

Facebook's CFO David Ebersman is in talks with Silicon Valley bankers about an IPO, but founder CEO Mark Zuckerberg has not decided on any terms of the IPO, the Journal said.

YM did not make a breakout from the pullback at around 11:00 am. ET.

Instead, it starts to bow down after the lunch break as can be seen from this 5-min. chart.

No follow through!

Though there is a tendency for a breakout before the close, but the risk is high the way I read the price action.

Not much conviction on the part of the participants at this time.

Instead, it starts to bow down after the lunch break as can be seen from this 5-min. chart.

No follow through!

Though there is a tendency for a breakout before the close, but the risk is high the way I read the price action.

Not much conviction on the part of the participants at this time.

Showing this 5-min. chart of the YM Futures, which continues to go up.

Trading this kind of pattern needs a lot of confirmation considering the market is news driven.

Waiting for a pullback can be the best place to locate an entry.

But I guess the right place of entry is at around 11520 - 11525 for a long trade.

Let's see how it goes for a pullback.

Trading this kind of pattern needs a lot of confirmation considering the market is news driven.

Waiting for a pullback can be the best place to locate an entry.

But I guess the right place of entry is at around 11520 - 11525 for a long trade.

Let's see how it goes for a pullback.

Finally, the sheep/reindeer form-a-like (the chart) that I've been watching starts to roar with its beard starts to grow after being shaved-off!

The market gap-up today and continues to soar.

The bears are covering in darkness looking for a cover up.

The market is oversold and the participants are bracing for bargain.

Lots of bear participants got short squeezed/stopped out, sorry for them.

Good for the bulls!..and they are in clouds...

The market gap-up today and continues to soar.

The bears are covering in darkness looking for a cover up.

The market is oversold and the participants are bracing for bargain.

Lots of bear participants got short squeezed/stopped out, sorry for them.

Good for the bulls!..and they are in clouds...

Black Friday isn't the only game in town

What's in a name? Retailers roll out Green Tuesday, Magenta Saturday and others

PORTLAND, Ore. (AP) -- Cyber Monday. Green Tuesday. Black Friday. Magenta Saturday.

Chances are you won't find any of these holidays on your calendar. Yet retailers are coming up with names for just about every day of the week during the holiday shopping season.

During T-Mobile's "Magenta Saturday," the event named for the company's pinkish-purple logo earlier this month offered shoppers the chance to buy cellphones and some tablets on a layaway plan. Mattel lured customers in with discounts of 60 percent off toys for girls and boys on "Pink Friday" and "Blue Friday." And outdoor retailer Gander Mountain is giving shoppers deals on camouflage and other gear every Thursday through December during "Camo Thursdays."

"There are hundreds of promotions going on this time of year," says Steve Uline, head of marketing for Gander. "We needed to do something a little bit different."

It's difficult to get Americans to spend money when many are struggling with job losses, underwater mortgages or dwindling retirement savings. But merchants are hoping some creative marketing will generate excitement among shoppers during the last two months of the year, a time when many of them make up to 40 percent of their annual revenue. And they know that a catchy name can make a huge difference.

"The more special you make it sound, the more you might be able to get people," says Allen Adamson, a managing director at brand consulting firm Landor Associates. "It's tricky to come up with something simple and sticky."

Retailers have done it before.

"Black Friday," the day after Thanksgiving, in the 1960s became known as the point when merchants turn a profit or operate "in the black." Later, retailers began marketing it as the start of the holiday shopping season with earlier store hours and deep discounts of up to 70 percent off.

It's since become the busiest shopping day of the year. This past weekend, "Black Friday" sales were $11.4 billion, up 7 percent, or nearly $1 billion from the same day last year, according to a report by ShopperTrak, which gathers data from 25,000 outlets across the country. It was the largest amount ever spent on that day.

But "Black Friday" has been a blessing and a curse: In recent years, it's become so popular that it's known for its big crowds, long lines, and even disorder and violence among some shoppers.

"Black Friday has become a victim of its own success," says Adamson, the branding expert. "It has been successful to the point where it has created the opportunity that if you don't want to deal with the madness, come out on Tuesday or some other day."

"Cyber Monday" was coined in 2005 when a retail trade group noticed a spike in online sales on the Monday after Thanksgiving when people returned to their work computers and shopped. While more people now have Internet access at home, retailers still offer discounts and other online promotions for the day started by Shop.org, part of The National Retail Federation.

The day has grown increasingly popular. Last year, it was the busiest online shopping day ever, with sales of more than $1 billion, according to research firm ComScore Inc.

During this week's "Cyber Monday," the NRF says nearly 80 percent of retailers plan to offer special promotions. And a record 122.9 million of Americans are expected to shop on the day, up from 106.9 million who shopped on "Cyber Monday" last year, according to a survey conducted for Shop.org.

Marketers are hoping to strike gold again. Many are doing so by appealing to Americans who've become disenchanted with big business and commercialism.

Nonprofit Green America is launching "Green Tuesday" this week to encourage people to buy gifts with the environment and local communities in mind. The group is planning to push the event every Tuesday through December.

Green America, which says it aims to support society and the environment through economic programs, plans to showcase deals on its website, including jewelry made from recycled nuclear bomb equipment from online retailer Fromwartopeace.com and a self-watering system for plants by Dri Water.

"Mass culture encourages people to run out of their house, now at midnight, and go shopping," says Todd Larsen, director of corporate responsibility for Green America, which vetted the businesses it's highlighting on its website to ensure they meet certain environmental and ethical standards. "Why not wait another day or more and buy something that helps others?"

Last year, American Express named the Saturday after Thanksgiving "Small Business Saturday" to encourage Americans to shop at mom-and-pop shops. This year, it offered a $25 credit to cardholders who register on social media website Facebook and shop at participating stores.

The company says it launched a multibillion-dollar campaign to promote the day. The campaign included TV ads and marketing materials for small businesses to display in stores.

The effort has worked. Small retailers that accept Amex had a 28 percent increase in revenue during the daylong event last year, compared with a 9 percent rise for all retailers, according to card activity measured by American Express. The company did not disclose the dollar amount spent that day.

It's not clear yet how small businesses fared during the event this past Saturday, but a company survey before "Small Business Saturday" showed that 89 million consumers had planned to "shop small" on the day.

"People get it; they are behind it 100 percent," says Yabette Alfaro, owner of Swankity Swank, a San Francisco home furnishings and accessories shop that participates in "Small Business Saturday." "Our customers don't want to participate in Black Friday. Most of them think anyone making a stand is great."

Lizbeth Turq, a 26-year old in Deerfield, Ill., this past weekend shopped at several local shops during "Small Business Saturday." She ended up buying some gifts for the holidays, including one for her mother at a home décor store. Most of the items she found were 20 percent off, she says.

"It's really not an issue of having a sale or not," Turq says, "It's an issue of supporting the community I live in and creating jobs, particularly in the economy we are in.".

Sunday, November 27, 2011

IMF Package Denial Sends ES And EURUSD Tumbling

Well they bought the rumor and now comes the sell-the-news/rumor/denial part of the evening as Dow Jones cites an official that 'No Discussion Within G-7 Of Reported Large Package For Italy".

EUR lost 40pips and ES around 10pts as the latter compressed close to CONTEXT's broad risk view of the world.

Well they bought the rumor and now comes the sell-the-news/rumor/denial part of the evening as Dow Jones cites an official that 'No Discussion Within G-7 Of Reported Large Package For Italy".

EUR lost 40pips and ES around 10pts as the latter compressed close to CONTEXT's broad risk view of the world.

Here is the top 10 list from billionaires as to be successful:

1. Figure out what you’re so passionate about that you’d be happy doing it for 10 years, even if you never made any money from it. That’s what you should be doing.

2. Always be true to yourself.

3. Figure out what your values are and live by them, in business and in life.

4. Rather than focus on work-life separation, focus on work-life integration.

5. Don’t network. Focus on building real relationships and friendships where the relationship itself is its own reward, instead of trying to get something out of the relationship to benefit your business or yourself.

6. Remember to maximize for happiness, not money or status.

7. Get ready for rejection.

8. Success unshared is failure. Give back — share your wealth.

10. Successful people do all the things unsuccessful people don’t want to do.

Saturday, November 26, 2011

When It Is Best To Do Nothing – Do Nothing

by Olivier on November 23, 2011

I could literally list thousands of quotes on why at times it is important to stand aside, why you need to know when it is best to do nothing and to stay in cash when the market is not conducive to trading big or trading at all. In my opinion it simply comes down to the following: You need to know yourself very well. Know about your strengths and weaknesses. Put another way: There’s a time to be aggressive and there’s a time to be defensive. I recently quoted Brett Steenbarger. I wanted to explain why I chose that specific quote as the true meaning of the quote might have gone unnoticed:

My point is: Selection is key. Be patient. Only trade the best set-ups. Let the trade come to you. When conditions are right go for the throat. If you are always 100% invested you won’t be able to trade that way. In closing I want to quote verbatim what Dan Zanger recently tweeted. Excellent advice indeed:

It’s making the most of strengths and learning how to work around shortcomings that produces optimal performance results. – Brett SteenbargerThe point he wants to drive home is that focusing on your strengths is a better use of your time as opposed to focusing too much on your weaknesses. Put another way: You will make more money if you focus on trading set-ups during market environments that are conducive to your type of trading and your personality. Trying to trade aggressively during other times is akin to trading situations and set-ups you are not good at. You guessed it. It means you are focusing too much on your weaknesses. The solution is to admit one’s shortcomings. The earlier you do that and the more honest you are when it comes to gauging your strengths and weaknesses, the better your results will be in the long run. That’s why I like the following quote:

Have the courage to say no.Why do I stress all those things? I typically get a lot of feedback when it comes to going to cash or being in cash. Most people have a really tough time understanding that concept. Optimal performance cannot be attained if you are 100% invested in the markets all of the time. “Less is more” is an adage that comes to mind dealing with that issue.

Have the courage to face the truth.

Have the courage to do the right thing because it is right.

– W. Clement Stone

My point is: Selection is key. Be patient. Only trade the best set-ups. Let the trade come to you. When conditions are right go for the throat. If you are always 100% invested you won’t be able to trade that way. In closing I want to quote verbatim what Dan Zanger recently tweeted. Excellent advice indeed:

I have sat in a high percentage of cash for almost 4 months. Not the kind of market to build big positions. – Dan Zanger

Five Guiding Principles of Trading Psychology

By Brett Steenbarger

I recently participated in an online chat presentation for John Forman where I assembled my ideas into ten basic principles that have guided my thinking about the psychology of traders and the psychology of markets. In the very near future, if my testing continues to be promising, I hope to present a market indicator for swing traders that rests firmly upon these principles. In the interim, here are the five principles that pertain specifically to trading psychology and in future I will also give five principles for trading the markets.

Principle #1: Trading is a performance activity

Like the playing of a concert instrument or the playing of a sport, trading entails the application of knowledge and skills to real time performances and this is the core idea behind my most recent book. Success at trading, as with other performances, depends upon a developmental process in which intensive, structured practice and experience over an extended time yield competence and expertise. Many trading problems are attributable to attempts to succeed at trading prior to undergoing this learning process. My research suggests that professional traders account for well over three-quarters of all share and futures contract volume. It is impossible to sustain success against these professionals without honing one's performance--and by making sure that you don't lose your capital in the learning process. Confidence in one's trading comes from the mastery conferred by one's learning and development, not from psychological exercises or insights.

Principle #2: Success in trading is a function of talents and skills

Trading, in this sense, is no different from chess, Olympic events, or acting. Inborn abilities (talents) and developed competencies (skills) determine one's level of success. From rock bands to ballet dancers and golfers, only a small percentage of participants in any performance activity are good enough to sustain a living from their performances. The key to success is finding a seamless fit between one's talents/skills and the specific opportunities available in a performance field. For traders, this means finding a superior fit between your abilities and the specific markets and strategies you will be trading. Many performance problems are the result of a suboptimal fit between what the trader is good at and how the trader is trading.

Principle #3: The core skill of trading is pattern recognition

Whether the trader is visually inspecting charts or analyzing signals statistically, pattern recognition lies at the heart of trading. The trader is trying to identify shifts in demand and supply in real time and is responding to patterns that are indicative of such shifts. Most of the different approaches to trading--technical and fundamental analysis, cycles, econometrics, quantitative historical analysis, Market Profile--are simply methods for conceptualizing patterns at different time frames. Traders will benefit most from those methods that fit well with their cognitive styles and strengths. A person adept at visual processing, with superior visual memory, might benefit from the use of charts in framing patterns. Someone who is highly analytical might benefit from statistical studies and mechanical signals.

Principle #4: Much pattern recognition is based on implicit learning

Implicit learning occurs when people are repeatedly exposed to complex patterns and eventually internalize those, even though they cannot verbalize the rules underlying those patterns. This is how children learn language and grammar, and it is how we learn to navigate our way through complex social interactions. Implicit learning manifests itself as a "feel" for a performance activity and facilitates a rapidity of pattern recognition that would not be possible through ordinary analysis. Even system developers, who rely upon explicit signals for trading, report that their frequent exposure to data gives them a feel for which variables will be promising and which will not during their testing. Research tells us that implicit learning only occurs after we have undergone thousands of learning trials. This is why trading competence--like competence at other performance activities such as piloting a fighter jet and chess--requires considerable practice and exposure to realistic scenarios. Without such immersive exposure, traders never truly internalize the patterns in their markets and time frames.

Principle #5: Emotional, cognitive, and physical factors disrupt access to patterns we have acquired implicitly

Once a performer has developed skills and moved along the path toward competence and expertise, psychology becomes important in sustaining consistency of performance. Many performance disruptions are caused when shifts in our cognitive, emotional, and/or physical states obscure the felt tendencies and intuitions that lie at the heart of implicit learning. This most commonly occurs as a result of performance anxiety--our fears about the outcome of our performance interfere with the access to the knowledge and skills needed to facilitate that performance. Such performance disruptions also commonly occur when traders trade positions that are too large for their accounts and/or do not maintain sound risk management with their positions. The large P/L swings cause shifts in emotional states that interfere with the (implicit) processing of market data. Cognitive, behavioral, and biofeedback methods can be very useful in teaching traders skills for maintaining the "Yoda state" of calm concentration needed to access implicit knowledge.

The most important question I can ask an aspiring trader is: Are you engaged in a structured training process? Education--simply reading articles in magazines, websites, blogs, and books--is important, but it is not training. Training is the systematic work on oneself to build skills and hone performance. It requires constant feedback about your performance--what is working and what isn't--and it requires a steady process of drilling skills until they become automatic. No amount of talking with a coach or counselor will substitute for the training process: not in trading, not in athletics, and not in the dramatic arts. Training yourself to proficiency is the path to a positive psychology.

I recently participated in an online chat presentation for John Forman where I assembled my ideas into ten basic principles that have guided my thinking about the psychology of traders and the psychology of markets. In the very near future, if my testing continues to be promising, I hope to present a market indicator for swing traders that rests firmly upon these principles. In the interim, here are the five principles that pertain specifically to trading psychology and in future I will also give five principles for trading the markets.

Principle #1: Trading is a performance activity

Like the playing of a concert instrument or the playing of a sport, trading entails the application of knowledge and skills to real time performances and this is the core idea behind my most recent book. Success at trading, as with other performances, depends upon a developmental process in which intensive, structured practice and experience over an extended time yield competence and expertise. Many trading problems are attributable to attempts to succeed at trading prior to undergoing this learning process. My research suggests that professional traders account for well over three-quarters of all share and futures contract volume. It is impossible to sustain success against these professionals without honing one's performance--and by making sure that you don't lose your capital in the learning process. Confidence in one's trading comes from the mastery conferred by one's learning and development, not from psychological exercises or insights.

Trading, in this sense, is no different from chess, Olympic events, or acting. Inborn abilities (talents) and developed competencies (skills) determine one's level of success. From rock bands to ballet dancers and golfers, only a small percentage of participants in any performance activity are good enough to sustain a living from their performances. The key to success is finding a seamless fit between one's talents/skills and the specific opportunities available in a performance field. For traders, this means finding a superior fit between your abilities and the specific markets and strategies you will be trading. Many performance problems are the result of a suboptimal fit between what the trader is good at and how the trader is trading.

Principle #3: The core skill of trading is pattern recognition

Whether the trader is visually inspecting charts or analyzing signals statistically, pattern recognition lies at the heart of trading. The trader is trying to identify shifts in demand and supply in real time and is responding to patterns that are indicative of such shifts. Most of the different approaches to trading--technical and fundamental analysis, cycles, econometrics, quantitative historical analysis, Market Profile--are simply methods for conceptualizing patterns at different time frames. Traders will benefit most from those methods that fit well with their cognitive styles and strengths. A person adept at visual processing, with superior visual memory, might benefit from the use of charts in framing patterns. Someone who is highly analytical might benefit from statistical studies and mechanical signals.

Principle #4: Much pattern recognition is based on implicit learning

Implicit learning occurs when people are repeatedly exposed to complex patterns and eventually internalize those, even though they cannot verbalize the rules underlying those patterns. This is how children learn language and grammar, and it is how we learn to navigate our way through complex social interactions. Implicit learning manifests itself as a "feel" for a performance activity and facilitates a rapidity of pattern recognition that would not be possible through ordinary analysis. Even system developers, who rely upon explicit signals for trading, report that their frequent exposure to data gives them a feel for which variables will be promising and which will not during their testing. Research tells us that implicit learning only occurs after we have undergone thousands of learning trials. This is why trading competence--like competence at other performance activities such as piloting a fighter jet and chess--requires considerable practice and exposure to realistic scenarios. Without such immersive exposure, traders never truly internalize the patterns in their markets and time frames.

Principle #5: Emotional, cognitive, and physical factors disrupt access to patterns we have acquired implicitly

Once a performer has developed skills and moved along the path toward competence and expertise, psychology becomes important in sustaining consistency of performance. Many performance disruptions are caused when shifts in our cognitive, emotional, and/or physical states obscure the felt tendencies and intuitions that lie at the heart of implicit learning. This most commonly occurs as a result of performance anxiety--our fears about the outcome of our performance interfere with the access to the knowledge and skills needed to facilitate that performance. Such performance disruptions also commonly occur when traders trade positions that are too large for their accounts and/or do not maintain sound risk management with their positions. The large P/L swings cause shifts in emotional states that interfere with the (implicit) processing of market data. Cognitive, behavioral, and biofeedback methods can be very useful in teaching traders skills for maintaining the "Yoda state" of calm concentration needed to access implicit knowledge.

The market doesn't show any kind of positive movement based from the chart shown below.

Though a light volume was registered last Friday's trading, but the sentiments reflected on the chart speaks for itself.

The market seems looking for a "motivation" to move upwards.

It breaks out in the open but went back from its original price in the close.

Lack of conviction from the participants.

It is still a trader's market.

Though a light volume was registered last Friday's trading, but the sentiments reflected on the chart speaks for itself.

The market seems looking for a "motivation" to move upwards.

It breaks out in the open but went back from its original price in the close.

Lack of conviction from the participants.

It is still a trader's market.

Friday, November 25, 2011

The market starts to stabilize as shown from this 5-min. chart.

Finally, the market got its bearing and rises from the ashes.

It's been burning totally for almost two weeks.

Let's see come Monday if it's going to continue after today's short trading schedule, the market will close at 2:00 pm. ET.

Today's trading is a light volume day for traders/investors are on a Holiday retreat.

Only those who sleep and breaths with the market are the participants.

It is a nice breakout from the opening bell today in the market, no noise!

Buying at the open and take your Starbucks coffee from the nearby and exit your position at the close can make you a paycheck for a week?...how's that in trading as compared working for fck*&?'thers...

Finally, the market got its bearing and rises from the ashes.

It's been burning totally for almost two weeks.

Let's see come Monday if it's going to continue after today's short trading schedule, the market will close at 2:00 pm. ET.

Today's trading is a light volume day for traders/investors are on a Holiday retreat.

Only those who sleep and breaths with the market are the participants.

It is a nice breakout from the opening bell today in the market, no noise!

Buying at the open and take your Starbucks coffee from the nearby and exit your position at the close can make you a paycheck for a week?...how's that in trading as compared working for fck*&?'thers...

Wall Street rebounds after six losing sessions

By Edward Krudy

NEW YORK (Reuters) - Stocks rose on Friday, on course to snap a six-session losing streak, as a buoyant start to the holiday shopping season helped offset fears about the euro zone's debt crisis after another leap in Italian bond yields.

Reinforcing what some see as recent signs of strength in the U.S. economy, shoppers stateside flocked to stores, which opened early to offer a jumpstart to "Black Friday," the traditional beginning to the U.S. holiday shopping season. The S&P Retail index (Chicago Options:^RLX) rose 0.4 percent.

"Anecdotally it seems that Black Friday is off to a positive start," said Todd Salamone, director of research at Schaeffer's Investment Research.

Europe will continue to predominate, he said. "We may have days when the U.S. market separates itself for whatever reason, but everything is about Europe right now."

Yields on Italy's debt approached recent highs that sparked a sell-off in world markets. Italy paid a record 6.5 percent to borrow money over six months on Friday, and its longer-term funding costs soared far above levels seen as sustainable for public finances.

The Dow Jones industrial average (DJI:^DJI) gained 53.32 points, or 0.47 percent, to 11,310.87. The Standard & Poor's 500 Index (SNP:^GSPC) rose 6.47 points, or 0.56 percent, to 1,168.26. The Nasdaq Composite Index (Nasdaq:^IXIC) added 9.50 points, or 0.39 percent, to 2,469.58.

Friday's moves looked to steer indexes away from ending with a second consecutive week of losses. The S&P 500 had lost almost 4 percent this week and given back almost two-thirds of its gains in October, the market's best month in 20 years.

A European Union conference in Strasbourg produced little to ease the markets fears, said Peter Cardillo, chief market economist at Rockwell Global Capital in New York.

"What they agreed to was not bickering in public," he said. "The markets are going to continue to pressure the EU until they come up with a solution that is going to ease the crisis."

For many investors that means the European Central Bank printing euros to buy larger amounts of European bonds and for Germany to accept the issuance of euro bonds. Germany currently opposes both of those options.

U.S. stock markets, closed for the Thanksgiving holiday on Thursday, will end trading on Friday at 1 p.m. The day after Thanksgiving is typically one of the lightest trading volume days of the year.

NEW YORK (Reuters) - Stocks rose on Friday, on course to snap a six-session losing streak, as a buoyant start to the holiday shopping season helped offset fears about the euro zone's debt crisis after another leap in Italian bond yields.

Reinforcing what some see as recent signs of strength in the U.S. economy, shoppers stateside flocked to stores, which opened early to offer a jumpstart to "Black Friday," the traditional beginning to the U.S. holiday shopping season. The S&P Retail index (Chicago Options:^RLX) rose 0.4 percent.

"Anecdotally it seems that Black Friday is off to a positive start," said Todd Salamone, director of research at Schaeffer's Investment Research.

Europe will continue to predominate, he said. "We may have days when the U.S. market separates itself for whatever reason, but everything is about Europe right now."

Yields on Italy's debt approached recent highs that sparked a sell-off in world markets. Italy paid a record 6.5 percent to borrow money over six months on Friday, and its longer-term funding costs soared far above levels seen as sustainable for public finances.

The Dow Jones industrial average (DJI:^DJI) gained 53.32 points, or 0.47 percent, to 11,310.87. The Standard & Poor's 500 Index (SNP:^GSPC) rose 6.47 points, or 0.56 percent, to 1,168.26. The Nasdaq Composite Index (Nasdaq:^IXIC) added 9.50 points, or 0.39 percent, to 2,469.58.

Friday's moves looked to steer indexes away from ending with a second consecutive week of losses. The S&P 500 had lost almost 4 percent this week and given back almost two-thirds of its gains in October, the market's best month in 20 years.

A European Union conference in Strasbourg produced little to ease the markets fears, said Peter Cardillo, chief market economist at Rockwell Global Capital in New York.

"What they agreed to was not bickering in public," he said. "The markets are going to continue to pressure the EU until they come up with a solution that is going to ease the crisis."

For many investors that means the European Central Bank printing euros to buy larger amounts of European bonds and for Germany to accept the issuance of euro bonds. Germany currently opposes both of those options.

U.S. stock markets, closed for the Thanksgiving holiday on Thursday, will end trading on Friday at 1 p.m. The day after Thanksgiving is typically one of the lightest trading volume days of the year.

Thursday, November 24, 2011

Fearful European bankers see little to be thankful for

While the United States turns its back on global gloom for a long holiday weekend, a failed German bond auction has finally brought home to Europeans the realization that nowhere is safe.

"It's as grim as hell. The only good thing is now everyone knows it's as grim as hell," one pale commuter was overheard telling a disheveled-looking colleague on their early-morning Tube ride into London's Canary Wharf financial hub.

Until this week Germany -- Europe's largest economy, with a hard line on austerity -- had been seen as the euro zone's last refuge and a source of comfort for the army of bankers, fund managers and traders caught in Europe's deepest financial crisis since World War Two.

Then came Wednesday's bond auction, in which Berlin found no buyers for almost half of a 6 billion euro 10-year bond offering at a record low 2.0 percent interest rate.

"Yesterday's German bund auction was a clear example that things they thought were on the periphery are now in the core... it's time to do something," said Thomas Becket, chief investment officer at funds firm Psigma Investment Management.

Bond investors have fled, interbank lending is drying up again and questions are being asked about the stability of the region's banking sector: while Americans tuck into turkeys, Europeans are finding life more frightening than festive.

One senior European banker, who declined to be named, said many of his colleagues had been "crisis-deniers" and were given false hope of a rapid return to big bonuses and job security by the significant economic rally in 2009.

"What they are realizing now, and it's even more brutal for them, is that this is in fact the new normal, that the industry is going back to what it was in the early 2000s," the banker said, adding that the recent round of layoffs had cut much deeper than the last, because no bank was hiring.

WORSE THAN LEHMAN?

The quarter following the September 2008 collapse of U.S. investment bank Lehman Brothers has long since served as the benchmark for the lowest ebb of banker morale in living memory, but consensus is quickly shifting.

At a capital markets conference hosted by IFR at the Thomson Reuters' London headquarters on Thursday, bankers and investors exchanged sober greetings like "How are you holding up?" and "are you surviving ok?."

When an attendee expressed surprise at seeing an acquaintance at the event, the fellow delegate drily replied: "It is not like any of us have much to do at the moment."

Depression and stress are sweeping the financial sector, industry sources say, as working weeks gobble up weekends and bankers and traders nervously accept they don't know whether they will still be employed in the New Year.

"You can spend more time on pitching and marketing but sometimes you have to stop and say, 'there is nothing we can do.' And you see people just leave (to go home)," one debt capital markets banker said.

This rock-bottom sentiment can be observed right across the financial sector.

Money men once cynically described as the "Masters of the Universe" are feeling powerless to influence, much less prevent a potential unraveling of Europe's monetary union -- a calamity that would define their generation, possibly even the century.

"You have to think that eventually the penny will drop and they'll have to do something. But...quite sensible people were sitting around in 1914 and saying Europe's not going to tear itself apart over some arch duke being shot by a Serbian fanatic, is it?," said Rob Burgeman, a director at British investment manager Brewin Dolphin.

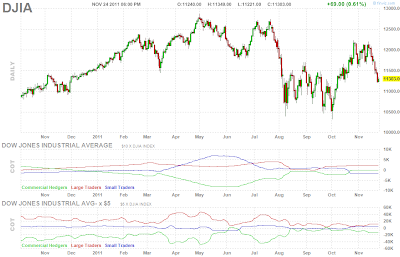

A sheep? form-a-like for the Dow chart?

I had been noticing this form-a-like from the Dow the past few days.

Though the market is struggling to get its traction for a breakout, its been on the downtrend/sell off the past two weeks now.

Just for my own thoughts for noticing the form-a-like sheep because of the approaching holidays.

Maybe the market will surge before the Christmas?, who knows.

But the way I psych the market, seems it will.

The market is also an exercise in psychology and human emotions, I bet the market might get its bearing before the year ends.

See the charts and form your own visualization.

I had been noticing this form-a-like from the Dow the past few days.

Though the market is struggling to get its traction for a breakout, its been on the downtrend/sell off the past two weeks now.

Just for my own thoughts for noticing the form-a-like sheep because of the approaching holidays.

Maybe the market will surge before the Christmas?, who knows.

But the way I psych the market, seems it will.

The market is also an exercise in psychology and human emotions, I bet the market might get its bearing before the year ends.

See the charts and form your own visualization.

Wednesday, November 23, 2011

World stocks hit by signs of slowdown in China, US

World stocks down after US cuts 3Q growth estimate, survey shows China manufacturing slowdown

BANGKOK (AP) -- World stocks fell Wednesday after a survey showed China's

factories are cutting production and the U.S. lowered its third quarter growth

estimate, adding to pessimism from Europe's simmering debt crisis.

Benchmark oil fell below $97 a barrel while the dollar strengthened against the euro and held steady against the yen.

European shares sank in early trading. Britain's FTSE 100 fell 0.3 percent to 5,191.94 and Germany's DAX lost 0.4 percent to 5513.08. France's CAC-40 was down 1 percent to 2,844.49.

Futures augured a lower open on Wall Street. Dow Jones industrial futures lost 0.7 percent to 11,362 while S&P 500 futures slipped 0.8 percent to 1,173.10.

Asian stock markets posted broad losses earlier in the day, hit by the signs of weakness in the world's two biggest economies. The U.S., a major market for Asia's exporters, grew at a 2 percent annual rate from July through September, down from an initial estimate of 2.5 percent. China, meanwhile, suffered a fall in manufacturing activity in November, according to a preliminary survey.

Hong Kong's Hang Seng slid 2.1 percent to 17,864.43. South Korea's Kospi lost 2.4 percent to 1,783.10 and Australia's S&P/ASX 200 shed 2 percent to 4,051. Mainland China's Shanghai Composite Index fell 0.7 percent to 2,395.07, posting its sixth straight session of losses. Japanese stock markets were closed for a public holiday.

Jackson Wong, vice president of Tanrich Securities in Hong Kong, said already weak market sentiment was further dampened by HSBC's China manufacturing index showing a contraction in activity.

The manufacturing gauge fell to 48 in November from 51 in October — its sharpest fall since March 2009. A reading below 50 indicates contraction from the previous month, but the index often undergoes significant revision from its preliminary level.

"The market is still waiting for some kind of price catalyst to bound back. Otherwise, we still trend down bit by bit until something happens," Wong said.

Higher borrowing costs for Spain, meanwhile, renewed worries about Europe's debt crisis. The higher rates suggest that investors are still skeptical that the country will get its budget under control despite a new government coming to power this week.

Investors have been worried that Spain could become the next country to need financial support from its European neighbors if its borrowing rates climb to unsustainable levels.

Greece was forced to seek relief from its lenders after its long-term borrowing rates rose above 7 percent. The rate on Spain's own benchmark 10-year bond is dangerously close to that level, 6.58 percent.

Underscoring jitters was the lack of market reaction to an announcement by the International Monetary Fund that it will provide quick cash on flexible terms to countries facing sudden financial stress.

"Failure of this news to result in significant gains across markets shows just how cautious investors are," Stan Shamu of IG Markets in Melbourne said in a report.

Concerns remain that Europe's debt crisis is pushing the region toward recession, which would slow industrial activity in countries around the world that export to Europe.

Australian resource shares took a big hit after the country's House of Representatives approved a law imposing a windfall profits tax on big mining companies. The Senate is expected to endorse the measure in early 2012.

BHP Billiton, the world's largest mining company, fell 3.1 percent. Rival Rio Tinto lost 3.4 percent and Energy Resources of Australia plummeted 5.9 percent.

In Seoul, auto parts maker Mando rose 2.6 percent on hopes that a free trade pact between South Korea and Washington would boost its earnings, Yonhap News Agency reported.

On Tuesday, the Dow Jones industrial average lost 0.5 percent to close at 11,493.72. The Standard & Poor's 500 fell 0.4 percent to 1,188.04. The Nasdaq composite fell 0.1 percent to 2,521.28.

Benchmark oil for January delivery was down $1.04 to $96.97 a barrel in electronic trading on the New York Mercantile Exchange. The contract rose $1.09 to finish at $98.01 per barrel on the Nymex on Tuesday.

In currencies, the euro fell to $1.3457 from $1.3509 late Tuesday in New York. The dollar was little changed at 76.98 yen.

Benchmark oil fell below $97 a barrel while the dollar strengthened against the euro and held steady against the yen.

European shares sank in early trading. Britain's FTSE 100 fell 0.3 percent to 5,191.94 and Germany's DAX lost 0.4 percent to 5513.08. France's CAC-40 was down 1 percent to 2,844.49.

Futures augured a lower open on Wall Street. Dow Jones industrial futures lost 0.7 percent to 11,362 while S&P 500 futures slipped 0.8 percent to 1,173.10.

Asian stock markets posted broad losses earlier in the day, hit by the signs of weakness in the world's two biggest economies. The U.S., a major market for Asia's exporters, grew at a 2 percent annual rate from July through September, down from an initial estimate of 2.5 percent. China, meanwhile, suffered a fall in manufacturing activity in November, according to a preliminary survey.

Hong Kong's Hang Seng slid 2.1 percent to 17,864.43. South Korea's Kospi lost 2.4 percent to 1,783.10 and Australia's S&P/ASX 200 shed 2 percent to 4,051. Mainland China's Shanghai Composite Index fell 0.7 percent to 2,395.07, posting its sixth straight session of losses. Japanese stock markets were closed for a public holiday.

Jackson Wong, vice president of Tanrich Securities in Hong Kong, said already weak market sentiment was further dampened by HSBC's China manufacturing index showing a contraction in activity.

The manufacturing gauge fell to 48 in November from 51 in October — its sharpest fall since March 2009. A reading below 50 indicates contraction from the previous month, but the index often undergoes significant revision from its preliminary level.

"The market is still waiting for some kind of price catalyst to bound back. Otherwise, we still trend down bit by bit until something happens," Wong said.

Higher borrowing costs for Spain, meanwhile, renewed worries about Europe's debt crisis. The higher rates suggest that investors are still skeptical that the country will get its budget under control despite a new government coming to power this week.

Investors have been worried that Spain could become the next country to need financial support from its European neighbors if its borrowing rates climb to unsustainable levels.

Greece was forced to seek relief from its lenders after its long-term borrowing rates rose above 7 percent. The rate on Spain's own benchmark 10-year bond is dangerously close to that level, 6.58 percent.

Underscoring jitters was the lack of market reaction to an announcement by the International Monetary Fund that it will provide quick cash on flexible terms to countries facing sudden financial stress.

"Failure of this news to result in significant gains across markets shows just how cautious investors are," Stan Shamu of IG Markets in Melbourne said in a report.

Concerns remain that Europe's debt crisis is pushing the region toward recession, which would slow industrial activity in countries around the world that export to Europe.

Australian resource shares took a big hit after the country's House of Representatives approved a law imposing a windfall profits tax on big mining companies. The Senate is expected to endorse the measure in early 2012.

BHP Billiton, the world's largest mining company, fell 3.1 percent. Rival Rio Tinto lost 3.4 percent and Energy Resources of Australia plummeted 5.9 percent.

In Seoul, auto parts maker Mando rose 2.6 percent on hopes that a free trade pact between South Korea and Washington would boost its earnings, Yonhap News Agency reported.

On Tuesday, the Dow Jones industrial average lost 0.5 percent to close at 11,493.72. The Standard & Poor's 500 fell 0.4 percent to 1,188.04. The Nasdaq composite fell 0.1 percent to 2,521.28.

Benchmark oil for January delivery was down $1.04 to $96.97 a barrel in electronic trading on the New York Mercantile Exchange. The contract rose $1.09 to finish at $98.01 per barrel on the Nymex on Tuesday.

In currencies, the euro fell to $1.3457 from $1.3509 late Tuesday in New York. The dollar was little changed at 76.98 yen.

Sunday, November 20, 2011

Richard Rhodes' Trading Rules

Richard Rhodes passes along these “ridiculously simple” trading rules, given to him by “a great trader some 15 years ago.”

Follow these rules, breaking them infrequently, and you will make money year in and year out.

The rules are simple. Sticking to them is what’s difficult.

Follow these rules, breaking them infrequently, and you will make money year in and year out.

The rules are simple. Sticking to them is what’s difficult.

“Old Rules…but Very Good Rules”

- The first and most important rule is – in bull markets, one is supposed to be long. This may sound obvious, but how many of us have sold the first rally in every bull market, saying that the market has moved too far, too fast. I have before, and I suspect I’ll do it again at some point in the future. Thus, we’ve not enjoyed the profits that should have accrued to us for our initial bullish outlook, but have actually lost money while being short. In a bull market, one can only be long or on the sidelines. Remember, not having a position is a position.

- Buy that which is showing strength –sell that which is showing weakness. The public continues to buy when prices have fallen. The professional buys because prices have rallied. This difference may not sound logical, but buying strength works. The rule of survival is not to “buy low, sell high”, but to “buy higher and sell higher”. Furthermore, when comparing various stocks within a group, buy only the strongest and sell the weakest.

- When putting on a trade, enter it as if it has the potential to be the biggest trade of the year. Don’t enter a trade until it has been well thought out, a campaign has been devised for adding to the trade, and contingency plans set for exiting the trade.

- On minor corrections against the major trend, add to trades. In bull markets, add to the trade on minor corrections back into support levels. In bear markets, add on corrections into resistance. Use the 33-50% corrections level of the previous movement or the proper moving average as a first point in which to add.

- Be patient. If a trade is missed, wait for a correction to occur before putting the trade on.

- Be patient. Once a trade is put on, allow it time to develop and give it time to create the profits you expected.

- Be patient. The old adage that “you never go broke taking a profit” is maybe the most worthless piece of advice ever given. Taking small profits is the surest way to ultimate loss I can think of, for small profits are never allowed to develop into enormous profits. The real money in trading is made from the one, two or three large trades that develop each year. You must develop the ability to patiently stay with winning trades to allow them to develop into that sort of trade.

- Be patient. Once a trade is put on, give it time to work; give it time to insulate itself from random noise; give it time for others to see the merit of what you saw earlier than they.

- Be impatient. As always, small loses and quick losses are the best losses. It is not the loss of money that is important. Rather, it is the mental capital that is used up when you sit with a losing trade that is important.

- Never, ever under any condition, add to a losing trade, or “average” into a position. If you are buying, then each new buy price must be higher than the previous buy price. If you are selling, then each new selling price must be lower. This rule is to be adhered to without question.

- Do more of what is working for you, and less of what’s not. Each day, look at the various positions you are holding, and try to add to the trade that has the most profit while subtracting from that trade that is either unprofitable or is showing the smallest profit. This is the basis of the old adage, “let your profits run.”

- Don’t trade until the technicals and the fundamentals both agree. This rule makes pure technicians cringe. I don’t care! I will not trade until I am sure that the simple technical rules I follow, and my fundamental analysis, are running in tandem. Then I can act with authority, and with certainty, and patiently sit tight.

- When sharp losses in equity are experienced, take time off. Close all trades and stop trading for several days. The mind can play games with itself following sharp, quick losses. The urge “to get the money back” is extreme, and should not be given in to.

- When trading well, trade somewhat larger. We all experience those incredible periods of time when all of our trades are profitable. When that happens, trade aggressively and trade larger. We must make our proverbial “hay” when the sun does shine.

- When adding to a trade, add only 1/4 to 1/2 as much as currently held. That is, if you are holding 400 shares of a stock, at the next point at which to add, add no more than 100 or 200 shares. That moves the average price of your holdings less than half of the distance moved, thus allowing you to sit through 50% corrections without touching your average price.

- Think like a guerrilla warrior. We wish to fight on the side of the market that is winning, not wasting our time and capital on futile efforts to gain fame by buying the lows or selling the highs of some market movement. Our duty is to earn profits by fighting alongside the winning forces. If neither side is winning, then we don’t need to fight at all.

- Markets form their tops in violence; markets form their lows in quiet conditions.

- The final 10% of the time of a bull run will usually encompass 50% or more of the price movement. Thus, the first 50% of the price movement will take 90% of the time and will require the most backing and filling and will be far more difficult to trade than the last 50%.

Tuesday, November 15, 2011

The market is going down as shown from this 5-min. chart from the Globex market.

It's a continuation from yesterday's downturn.

The market is being affected by the sad developments that is coming from Europe.

Unless investors/traders make up their decision making and continue to rely on these news, the market will be in the range mode for quite a while.

It's a continuation from yesterday's downturn.

The market is being affected by the sad developments that is coming from Europe.

Unless investors/traders make up their decision making and continue to rely on these news, the market will be in the range mode for quite a while.

Friday, November 11, 2011

In Search of a Winning Strategy

As traders we must attempt to identify profitable trading strategies; a creative process. Sifting through a wealth of information, mentally testing and retesting our strategy; attempting to decide if it will work under the current market environment, or which market environments are ideal for the strategy.

In your search there comes a point when you start to believe that you’re right. At this point in time, you must stop deliberating whether or not to go with a particular strategy, and make a final decision.

If you’re like many traders, however, you’ve made your share of bad decisions. Psychologists have studied the thought processes that go into making decisions. It’s a two-stage process, according to Dr. Daniel Gilbert, a professor of psychology at Harvard University. When you are evaluating a strategy, there comes a point in time, when you start to believe that it is true. That is the first stage of the decision making process, believing that you are right. The second stage consists of determining whether or not you are actually right.

The human mind seems to work in a peculiar way. In order to fully understand and mull over a strategy, we must first believe it is true, even if it is actually false. After we accept the strategy as true, we then go through a process of thinking and re-thinking the strategy before finally deciding if our initial acceptance of the strategy is prudent.

Let’s look at an example. Suppose you decided from what you have read and heard that a company that is about to announce earnings, was going to surprise on the upside. That is your hypothesis, your strategy. You first accept that you are right, that is stage 1 of the thinking process. After all if you thought your strategy was wrong you would just forget it and move on.

What if you decided the strategy was right, but then stopped deliberating, instead of continuing to question whether or not you made a good decision? If you avoid Stage 2 of the thinking process, you’ll continually jump to the wrong conclusion. You must think and rethink the strategy a little while longer; play Devil’s Advocate, think about what might go wrong. What is the risk if I am wrong, can I reasonably protect myself in that event?

Research studies have shown that when people are under time pressure, or tired and worn out, they do not fully deliberate their decisions. In other words, they engage in Stage 1 thinking, they accept that their hypothesis is true, but they avoid Stage 2 thinking; they assume their initial hunch is right without fully considering evidence that may refute its authenticity.

When making a trading decision, you must fully deliberate your alternatives. It’s perhaps a fine line between deliberating too much and being impulsive. Don’t rush the decision making process. Slow down, and realize your limitations.

Thursday, November 10, 2011

3 Psychological Quirks That Affect Your Trading

The most troublesome problems we face as traders are the ones that we don't

even know exist. Certain human tendencies affect our trading, yet we are often

completely unaware they are affecting us and our bottom line. While there are

many human tendencies, we will look at three that, if not managed, can block the

road toward achieving our financial goals.

The Enemy We Don't Know

When dealing with trading in a technical way, we can see where we erred and attempt to fix it for next time. If we exit a trade too early in a move, we can adjust our exit criteria by looking at a longer time frame or by using a different indicator. However, when we have a solid trading plan and are still losing money, we need to look at ourselves and our own psychology for a solution.

When we deal with our own minds, often our objectivity is skewed and, thus, cannot properly fix the problem; the true problem is clouded by biases and superficial trivialities. An example of this is the trader who does not stick to a trading plan, but fails to realize that "not sticking to it" is the problem, so he continually adjusts strategies, believing that is where the fault rests.

Awareness is Power

While there is no magic bullet for overcoming all of our problems or trading struggles, becoming aware of some possible base issues allows us to begin to monitor our thoughts and actions, so that over time we can change our habits. Awareness of potential psychological pitfalls can allow us to change our habits, hopefully creating more profits, let's look at three common psychological quirks that can often cause such problems.

Sensory Derived Bias

We pull information from around us to form an opinion or bias and this allows us to function and learn, in many cases. However, we must realize that, while we may believe we are forming an opinion based on factual evidence, often we are not. If a trader watches the business news each day and forms an opinion that the market is going higher, based on all the available information, he may feel he came to this conclusion by stripping away the media personnel's opinions and only listening to the facts. However, this trader still may face a problem: When the source of our information is biased, our own bias will be affected by that.

Even facts can be presented to give credence to the bias or opinion, but we must remember there is always another side to the story. Furthermore, constant exposure to a single opinion or viewpoint will lead individuals to believe that that is the only practical stance on the subject. Since they are deprived of counter evidence, their opinion will be biased by the available information.

Avoiding the Vague

Also known as fear of the unknown, avoiding what may occur, or what is not totally clear to us, prevents us from doing many things and can keep us locked in an unprofitable state. While it may sound ridiculous to some, traders may actually fear making money. They may not be aware of it consciously, but traders often worry about expanding their comfort zone, or simply fear that their profits will be taken away through taxes. Inevitably, this may lead to self sabotage. Another source of bias may come from trading only in the industry with which one is most familiar, even if that industry has been, and is predicted to continue, declining. The trader is avoiding an outcome because of the uncertainty associated with the investment.

Another common tendency relates to holding onto the losers too long, while selling the winners too quickly. When prices fluctuate we must factor in the magnitude of the movement, to determine if the change is due to noise or is the result of a fundamental effect. Pulling out of trades too quickly often results from ignoring the trend of the security, as investors adopt a risk-averse mentality. On the other hand, when investors experience a loss, they often become risk seekers, resulting in an over-held losing position. These deviations from rational behavior lead to irrational actions, causing investors to miss out on potential gains, due to psychological biases.

Tangibility of Anticipation

Anticipation is a powerful feeling. Anticipation is often associated with an "I want" or "I need" type of mentality. What we anticipate coming is some time in the future, but the feeling of anticipation is here now and it can be an enjoyable emotion. It can be so enjoyable, in fact, that we make feeling anticipation our focus, instead of achieving what it is we are anticipating in the first place. Knowing that a million dollars is going to show up on your doorstep tomorrow would create a fantastic feeling of excitement and anticipation. It is possible to become "addicted" to this feeling and thus put off taking payment.

While easy money delivered to the door is more than likely to be grabbed by the eager homeowner, when things are not quite as easy to come by, we can fall into using the feeling of anticipation as a consolation prize. Watching billions of dollars change hands each day, but not having the confidence to follow a plan and take a chunk of the money, can mean we subconsciously decided that dreaming about the profits is good enough. We want to be profitable, but "wanting" has become our goal, not profitability.

What to Do About It

Once we are aware that we may be affected by our own psychology, we realize it may affect our trading on a subconscious level. Awareness is often enough to inspire change, if we do in fact work to improve our trading.

There are several things we can do to overcome our psychological roadblocks, beginning with removing inputs that are obviously biased. Charts don't lie, but our perceptions of them may. We stand the best chance of success if we remain objective and focus on simple strategies that extract profits from price movements. Many great traders avoid the opinions of others, when it comes to the markets, and realize when an opinion may be affecting their trading.

Knowing how the markets operate and move will help us overcome our fear, or greed, while in trades. When we feel we have entered unknown territory where we don't know the outcome, we make mistakes. However, if we have a firm understanding, at least probabilistically, of how the markets move, we can base our actions on objective decision making.

Finally, we need to lay out what we really want, why we want it and how we are going to get there. Listen in on the thoughts that run through your head right when you make a mistake, and think about the belief behind it; then work to change that belief in your everyday life.

The Bottom Line

Our biases can affect our trading, even when we don't think we are trading on biased information. Also, when an outcome appears vague, we err in our judgment, even though we have a conception of how the market is supposed to move. Our anticipations can also be deterrents from achieving what it is we think we want. To aid us in these potential problems, we can remove biased inputs, gain more understanding of market probabilities and define what it is we really want from our trading.

The Enemy We Don't Know

When dealing with trading in a technical way, we can see where we erred and attempt to fix it for next time. If we exit a trade too early in a move, we can adjust our exit criteria by looking at a longer time frame or by using a different indicator. However, when we have a solid trading plan and are still losing money, we need to look at ourselves and our own psychology for a solution.

When we deal with our own minds, often our objectivity is skewed and, thus, cannot properly fix the problem; the true problem is clouded by biases and superficial trivialities. An example of this is the trader who does not stick to a trading plan, but fails to realize that "not sticking to it" is the problem, so he continually adjusts strategies, believing that is where the fault rests.

Awareness is Power

While there is no magic bullet for overcoming all of our problems or trading struggles, becoming aware of some possible base issues allows us to begin to monitor our thoughts and actions, so that over time we can change our habits. Awareness of potential psychological pitfalls can allow us to change our habits, hopefully creating more profits, let's look at three common psychological quirks that can often cause such problems.

Sensory Derived Bias

We pull information from around us to form an opinion or bias and this allows us to function and learn, in many cases. However, we must realize that, while we may believe we are forming an opinion based on factual evidence, often we are not. If a trader watches the business news each day and forms an opinion that the market is going higher, based on all the available information, he may feel he came to this conclusion by stripping away the media personnel's opinions and only listening to the facts. However, this trader still may face a problem: When the source of our information is biased, our own bias will be affected by that.

Even facts can be presented to give credence to the bias or opinion, but we must remember there is always another side to the story. Furthermore, constant exposure to a single opinion or viewpoint will lead individuals to believe that that is the only practical stance on the subject. Since they are deprived of counter evidence, their opinion will be biased by the available information.

Avoiding the Vague

Also known as fear of the unknown, avoiding what may occur, or what is not totally clear to us, prevents us from doing many things and can keep us locked in an unprofitable state. While it may sound ridiculous to some, traders may actually fear making money. They may not be aware of it consciously, but traders often worry about expanding their comfort zone, or simply fear that their profits will be taken away through taxes. Inevitably, this may lead to self sabotage. Another source of bias may come from trading only in the industry with which one is most familiar, even if that industry has been, and is predicted to continue, declining. The trader is avoiding an outcome because of the uncertainty associated with the investment.

Another common tendency relates to holding onto the losers too long, while selling the winners too quickly. When prices fluctuate we must factor in the magnitude of the movement, to determine if the change is due to noise or is the result of a fundamental effect. Pulling out of trades too quickly often results from ignoring the trend of the security, as investors adopt a risk-averse mentality. On the other hand, when investors experience a loss, they often become risk seekers, resulting in an over-held losing position. These deviations from rational behavior lead to irrational actions, causing investors to miss out on potential gains, due to psychological biases.

Tangibility of Anticipation

Anticipation is a powerful feeling. Anticipation is often associated with an "I want" or "I need" type of mentality. What we anticipate coming is some time in the future, but the feeling of anticipation is here now and it can be an enjoyable emotion. It can be so enjoyable, in fact, that we make feeling anticipation our focus, instead of achieving what it is we are anticipating in the first place. Knowing that a million dollars is going to show up on your doorstep tomorrow would create a fantastic feeling of excitement and anticipation. It is possible to become "addicted" to this feeling and thus put off taking payment.

While easy money delivered to the door is more than likely to be grabbed by the eager homeowner, when things are not quite as easy to come by, we can fall into using the feeling of anticipation as a consolation prize. Watching billions of dollars change hands each day, but not having the confidence to follow a plan and take a chunk of the money, can mean we subconsciously decided that dreaming about the profits is good enough. We want to be profitable, but "wanting" has become our goal, not profitability.

What to Do About It

Once we are aware that we may be affected by our own psychology, we realize it may affect our trading on a subconscious level. Awareness is often enough to inspire change, if we do in fact work to improve our trading.

There are several things we can do to overcome our psychological roadblocks, beginning with removing inputs that are obviously biased. Charts don't lie, but our perceptions of them may. We stand the best chance of success if we remain objective and focus on simple strategies that extract profits from price movements. Many great traders avoid the opinions of others, when it comes to the markets, and realize when an opinion may be affecting their trading.

Knowing how the markets operate and move will help us overcome our fear, or greed, while in trades. When we feel we have entered unknown territory where we don't know the outcome, we make mistakes. However, if we have a firm understanding, at least probabilistically, of how the markets move, we can base our actions on objective decision making.

Finally, we need to lay out what we really want, why we want it and how we are going to get there. Listen in on the thoughts that run through your head right when you make a mistake, and think about the belief behind it; then work to change that belief in your everyday life.

The Bottom Line

Our biases can affect our trading, even when we don't think we are trading on biased information. Also, when an outcome appears vague, we err in our judgment, even though we have a conception of how the market is supposed to move. Our anticipations can also be deterrents from achieving what it is we think we want. To aid us in these potential problems, we can remove biased inputs, gain more understanding of market probabilities and define what it is we really want from our trading.

MASTERING THE DOW FUTURES, YM

Traded YM Futures in the Globex market at midnight Pacific Time and made 48 points.

The reason YM was traded in the Globex is that there is a tendency it might rally or compensate the losses it incur during the regular trading.

Dow Futures lost around 300 points plus in the regular trading.

Based from my studies, whenever it drops a big points in the regular trading, it will recover somewhat in the Globex.

Shown is the chart that was traded in the Globex, the entry was at 11769 and the exit was at 11831.

Traded YM Futures in the Globex market at midnight Pacific Time and made 48 points.

The reason YM was traded in the Globex is that there is a tendency it might rally or compensate the losses it incur during the regular trading.

Dow Futures lost around 300 points plus in the regular trading.

Based from my studies, whenever it drops a big points in the regular trading, it will recover somewhat in the Globex.

Shown is the chart that was traded in the Globex, the entry was at 11769 and the exit was at 11831.

Wednesday, November 9, 2011

An ugly market movement today.

The market (YM) drops early in the morning from the Globex and into the regular open.

As of now, there is no indication it might turn around for the bears are aggressively in control.

Lots of selling from the participants, and there is no way for in home ordinary traders can do something.

The HFT or the quants are controlling the market right now.

Better to stay on the sidelines and just watch the market do its thing.

The market (YM) drops early in the morning from the Globex and into the regular open.

As of now, there is no indication it might turn around for the bears are aggressively in control.

Lots of selling from the participants, and there is no way for in home ordinary traders can do something.

The HFT or the quants are controlling the market right now.

Better to stay on the sidelines and just watch the market do its thing.

Tuesday, November 8, 2011

TRADE SUMMARY

After six tries of trading the market today, I finally recover the early losses and still lost a few because of poorly guess on my trailing stop.

The market was unpredictable today for it gave up some gain again in the open.

It's the same pattern as in the previous trading days range.

Showing the chart today wherein I got stopped out from the big red bar (with the arrow on top) which I made a mistake on putting close my trailing stop.

Made a big mistake there.

After six tries of trading the market today, I finally recover the early losses and still lost a few because of poorly guess on my trailing stop.

The market was unpredictable today for it gave up some gain again in the open.

It's the same pattern as in the previous trading days range.

Showing the chart today wherein I got stopped out from the big red bar (with the arrow on top) which I made a mistake on putting close my trailing stop.

Made a big mistake there.

US stock futures edge higher ahead of Italian vote

US stock futures edge higher ahead of confidence vote in Italy

NEW YORK (AP) -- U.S. stock futures are edging higher ahead of a key

confidence vote in Italy.

Italian bond yields spiked this week, a sign that Europe's debt crisis is far

from over. Unlike Greece, Portugal or Ireland -- all of which received financial

lifelines -- Italy has too much debt to be rescued by its European

neighbors.

Italian Premier Silvio Berlusconi's main coalition ally urged him to step

aside Tuesday ahead of a vote that could force his resignation. Many investors

believe a new government would enact additional austerity measures.

Dow futures were up 65 points, or 0.5 percent, to 12,073 two hours before the

market opened. S&P 500 futures rose 7, or 0.6 percent, to 1,264. Nasdaq 100

futures gained 19, or 0.8 percent, to 2,388.

Monday, November 7, 2011

The market made a nice u-turn late into the trading day for it was pummelled by the bears after the open.

It's a very volatile market and day traders love the market swings.

Investors are having a hard time coping with the high volatility the market brings.

The market is still in the range and it take more sentiments on the part of the participants for the market to go higher.

It's a very volatile market and day traders love the market swings.

Investors are having a hard time coping with the high volatility the market brings.

The market is still in the range and it take more sentiments on the part of the participants for the market to go higher.

Saturday, November 5, 2011